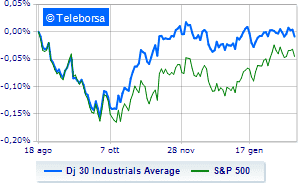

(Finance) – Wall Street continues the session at the levels recorded on the eve, reporting a variation of -0.17% on Dow Joneswhile, on the contrary, theS&P-500, which slips to 4,054 points. In sharp decline NASDAQ 100 (-1.54%); with similar direction, in red theS&P 100 (-1.04%).

Investors’ attention is focused on the “hawkish” positions of central bankers. Isabel Schnabel, a member of the ECB directorate believes a 50 basis point rate hike is necessary in March, but also some Fed exponents, such as Bullard and Mester, have returned to forecasting rates above 5% for the long term. To these were added the forecasts of other restrictive measures by the economists of Goldman Sachs and Bank of America (BofA)

To the top between Wall Street giants, Amgen (+2.51%), Merck (+1.92%), Travelers Company (+1.60%) and Johnson & Johnson (+1.46%).

The strongest declines, however, occur on Salesforce,which continues the session with -2.93%.

In red Chevronswhich shows a marked decrease of 2.52%.

The negative performance of intelwhich drops by 2.52%.

Microsoft drops by 1.99%.

Between protagonists of the Nasdaq 100, Amgen (+2.51%), Exelon (+1.84%), American Electric Power Company (+1.58%) and biogen (+1.52%).

The worst performances, however, are recorded on Diamondback Energy,which gets -5.32%.

At a loss AirBnbwhich drops by 5.24%.

Heavy Modernwhich marks a drop of as much as -5.11 percentage points.

Bad sitting for Baker Hugheswhich drops by 4.36%.

Between macroeconomic variables of greatest weight in the North American markets:

Friday 02/17/2023

2.30pm USA: Export Prices, Monthly (exp. -0.2%; previous -3.2%)

2.30pm USA: Import prices, monthly (exp. -0.2%; previous -0.1%)

4:00 pm USA: Leading indicator, monthly (exp. -0.3%; previous -0.8%)

Tuesday 02/21/2023

3.45pm USA: Manufacturing PMI (previously 46.9 points)

3.45pm USA: PMI services (previous 46.8 points).