(Finance) – Negative session for the markets of the Old Continent, while the Milan stock exchange sinks due to the country’s political instability. Italian BTPs are subject to sales and lo spread between Italian and German securities is widening after the 5 Star Movement announced that it intends to leave the Chamber at the time of the vote in the Senate on trust in the Aid decree, potentially leading to a fall of the current majority. The vote on DL aid is scheduled for early afternoon in the Senate.

“The main consequences we see at the market level in the case are a rise in the spread due to political uncertainty (although we expect mitigating action from the ECB), a greater risk of execution of PNRR plans (upon reaching the milestones at the end of 2022, Italy is expected to collect 19 billion European funds equal to 1% of GDP), the possible paralysis of some reforms (eg DL competition), a risk of delays in some politically sensitive dossiers (eg the single network, Rai Way / EI Towers) “, write the analysts of Equity.

“We are in very rough waters and we may find ourselves facing a storm because we have an ongoing war, risks on energy supplies and very high inflation. So it’s time for national cohesion, stability and a common front “, said the European Commissioner for Economy, Paolo Gentilonion the sidelines of the presentation of the economic forecasts for the summer

The European Commission has today cut growth estimates and increased inflation estimateswith the war in Ukraine continuing to negatively impact the EU economy, setting it on a path of lower growth and higher inflation than indicated in the spring forecast.

L’Euro / US dollar the session continues just below par, with a drop of 0.52%. Reverse thegold, which slipped to $ 1,712.7 an ounce. The Petroleum (Light Sweet Crude Oil) plunged 2.87%, falling as low as $ 93.54 per barrel.

Heavy increase of spreadwhich stands at +219 basis points, with a marked increase of 15 basis points, while the BTP with a 10 year maturity reports a yield of 3.36%.

Among the markets of the Old Continent decline decided for Frankfurtwhich marks -0.93%, under pressure Londonwith a sharp drop of 0.79%, and suffers Pariswhich shows a loss of 1.11%.

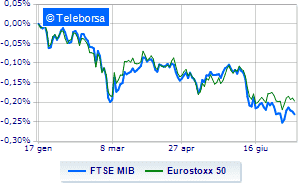

Session to forget for the Italian stock exchangewith the FTSE MIB which is leaving 2.53% on the ground, continuing the series of four consecutive declines, which began last Monday; along the same lines, the FTSE Italia All-Share it collapsed by 2.45%, down to 22,746 points. Heavy on FTSE Italia Mid Cap (-1.86%); on the same trend, down on FTSE Italia Star (-1.31%).

Between best performers of Milan, in evidence Saipem (+ 7.86%) e Amplifon (+ 1.95%).

The worst performances, on the other hand, are recorded on Banco BPMwhich gets -4.97%.

Bad performance for Telecom Italiawhich recorded a drop of 4.84%.

Black session for BPERwhich leaves a loss of 4.53% on the table.

Prey of the sellers Intesa Sanpaolowith a decrease of 4.21%.

Between best stocks in the FTSE MidCap, Ferragamo (+ 2.13%), Saint Lawrence (+ 0.94%), El.En (+ 0.90%) e GVS (+ 0.78%).

The strongest falls, on the other hand, occur on Technogymwhich continues the session with -5.82%.

At a loss De ‘Longhiwhich falls by 4.98%.

Heavy Mfe Awhich marks a drop of -4.63 percentage points.

Negative sitting for Banca Popolare di Sondriowhich falls by 4.49%.

Between macroeconomic variables heavier:

Thursday 14/07/2022

06:30 Japan: Industrial production, monthly (previous -1.5%)

14:30 USA: Production prices, annual (expected 10.7%; previous 10.8%)

14:30 USA: Unemployment Claims, Weekly (Expected 235K Units; Previously 235K Units)

14:30 USA: Production prices, monthly (expected 0.8%; previous 0.8%)

Friday 15/07/2022

04:00 China: GDP, quarterly (expected 0.6%; previous 1.3%).