Are we addicted to saving? The latest study from the BPCE observatory seems to confirm this. The latter traces the evolution of household assets since 1990 and draws surprising conclusions. The first: the French became considerably enriched during the period. “The outstanding amount, excluding unlisted shares, has multiplied by almost 5 in thirty-three years – from 902 billion euros, in 1990, to 4,427 billion euros, in 2023 – when inflation was only by 1.7″, underline the authors, Alain Tourdjman and Emmanuel Buffandeau, responsible for economic studies of the banking group.

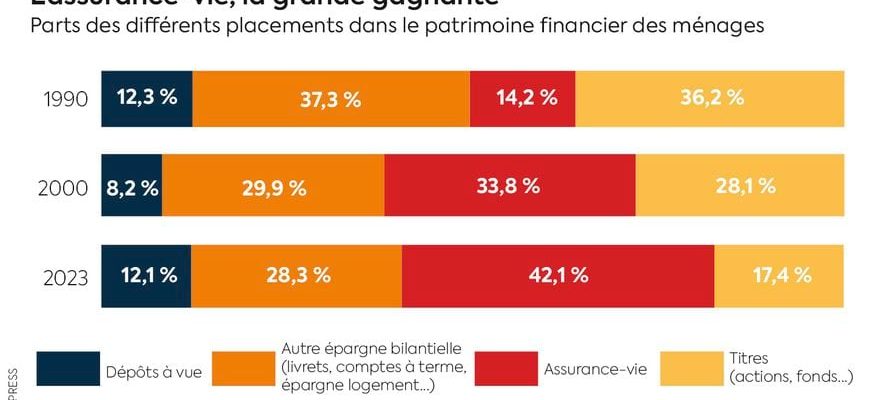

Another lesson: the investments favored by savers have evolved significantly over this period of time. Despite the current craze for savings accounts and term deposits, the share of so-called “balance sheet” savings has declined in thirty years: if it still represents 40% of financial assets currently, it represented almost half of that – this in the 1990s. Note, however, that the amounts left in current accounts are stable over a long period, around 12%. As such, 2023 was a year of post-Covid normalization: demand deposits experienced a historic contraction, with arbitrage towards other supports, of the order of 54 billion euros.

On the other hand, securities have been the big losers of recent decades: stocks, bonds and funds have seen their share reduce regularly to fall to 17.4% of the financial wealth of the French, half as much as in 1990. This drop is, however, a sham, because the star of the tricolor nest egg is life insurance, whose share jumped from 14.2 to 42.1%, exceeding 1,800 billion euros in -course ! However, the latter saw the volume of units of account – mainly funds – increase significantly in contracts, reaching 41% of collections last year.

3788_HEALTH_LIFE INSURANCE

© / The Express

In 2024, the authors expect the household savings rate relative to their income to stabilize at a high level, around 17.5%, well above its level before the Covid crisis. due to continued uncertainties, and a prolonged desire for precautionary savings and reconstitution of real wealth, in the face of the previous surge in inflation. They anticipate in particular a slowdown in collections on term accounts – the latter amounted to 70 billion euros in 2023 – and a rebound in that of life insurance, favored by the revaluation of the yield of funds in euros.