(Finance) – The main stock exchanges of the Old Continent were all positive. In Piazza Affari the focus of investors is on the two hot matches of these days. On one side Banco BPMwhich rips after that Crédit Agricole he got his hands on 9.2% of the capital of the Milanese bank, and on the other Atlantiawhich continues to gain ground on the rumors that Edition e Blackstone ready to launch a takeover bid astride Easter. The repercussions of the banking risk also affect Anima (which has Banco BPM as its main shareholder and strategic partner), whose stock soars in today’s session.

“We believe that the transaction is positive for Banco BPM given that on the one hand it is proof of the soundness of future prospects from an operational point of viewon the other hand, we believe it revives the speculative appeal on the stock, in light of the presence of a quality industrial investor like Credit Agricole, with a proven track-record in the M&A field – wrote the analysts of Equity – We believe that the likelihood of a business combination are high although the methods and methods timing will remain to be evaluated“.

“Anima could become an interesting target for Amundi“, the asset management company of Agricole, detect Bestinver analysts.” Both have the same business and Anima trades at a steep discount compared to Amundi. “” Anima could constitute a an important asset for both of us“, he notes Morgan Stanleywhich recalls how Banco BPM distributes around 60% of Anima’s products through its network, while Amundi’s distribution agreement with Unicreditsigned after the acquisition of Pioneer, will expire in 2026.

L’Euro / US dollar the session continues at the levels of the day before, reporting a variation equal to -0.14%. L’Gold the session continued at the levels of the day before, reporting a variation of + 0.05%. No significant change for the oil market, with oil (Light Sweet Crude Oil) settling on the eve of 96.08 dollars per barrel.

On the levels of the eve it spreadwhich remained at +169 basis points, with the yield on the ten-year BTP standing at 2.37%.

In the European stock market scenario positive trend for Frankfurtwhich advances by a decent + 1.4%, well bought Londonwhich marks a sharp rise of 1.09%, e Paris advances by 1.38%.

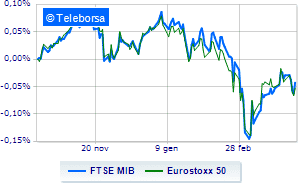

Strong upside exchanges for the Milan stock exchange, with the FTSE MIB, which is posting a 1.91% gain, thus blocking the bearish trail supported by three consecutive dips, which kicked off on Tuesday; along the same line, the FTSE Italia All-Sharewhich continues trading at 27,017 points.

Good performance of the FTSE Italia Mid Cap (+ 1.3%); in the same direction, the FTSE Italia Star (+ 0.75%).

Between best performers of Milan, in evidence Banco BPM (+ 15.14%), BPER (+ 3.80%), Moncler (+ 3.76%) e Iveco Group (+ 3.51%).

The strongest falls, on the other hand, occur on Telecom Italiawhich continues the session with -1.92%.

The negative performance of Amplifonwhich falls by 1.20%.

He hesitates DiaSorinwhich yields 0.95%.

Basically weak Campariwhich recorded a decline of 0.88%.

Between best stocks in the FTSE MidCap, Anima Holding (+ 8.19%), Banca Popolare di Sondrio (+ 5.65%), Credem (+ 3.42%) e Brunello Cucinelli (+ 3.24%).

The worst performances, on the other hand, are recorded on Alerion Clean Powerwhich gets -5.26%.

Negative sitting for Salcef Groupwhich drops by 3.24%.

Sensitive losses for Intercosdown 2.36%.

Rai Way drops by 1.22%.

Among macroeconomic appointments which will have the greatest influence on market trends:

Friday 08/04/2022

01:50 Japan: Current items (¥ 1,436.8 billion expected; ¥ -1,188.7 billion previously)

10:00 Italy: Retail sales, annual (previous 8.3%)

10:00 Italy: Retail sales, monthly (previous -0.6%)

4:00 pm USA: Wholesale stocks, monthly (expected 2.1%; previous 1.1%)

Monday 11/04/2022

02:30 China: Production prices, annual (expected 8.7%; previous 8.8%).