(Tiper Stock Exchange) – Nothing done for the main Stock Exchanges of the Old Continent, which exchanges on equality continue. In counter trend Piazza Affari, protagonist of a session in the red. The day was devoid of significant moments, also because the financial markets in North America are closed for holidays.

On the macroeconomic front, it is result the construction market is declining in the Eurozone in December 2022. Investors will also find themselves evaluating the first estimate of consumer confidence in the Eurozone for February, expected to improve slightly to -19 from -20.9 in January. There will be no publications in the United States.

As for the geopolitical scenario, this morning the president of the United States Joe Biden made a surprise visit to Kiev, at the start of a week that will mark the anniversary of Russia’s invasion of Ukraine. Biden said his visit was for “reaffirm our unwavering commitment and tireless for democracy, sovereignty and territorial integrity of Ukraine”.

L’Euro / US Dollar remains substantially stable at 1.068. L’Gold maintains substantially stable position at 1,843.7 dollars an ounce. Slight increase for the petrolium (Light Sweet Crude Oil), which shows an increase of 0.66%.

Consolidate the levels of the eve lo spreadscoming in at +177 basis points, with the yield of 10-year BTP which stands at 4.16%.

In the European stock market scenario without momentum Frankfurtwhich trades with -0.08%, London it is stable, reporting a moderate -0.03%, and disappointing Pariswhich lies just below the levels of the eve.

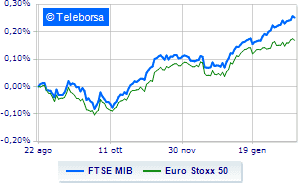

TO Milanmoves below parity the FTSEMIB, which drops to 27,681 points, with a percentage gap of 0.25%; along the same lines, depressed the FTSE Italia All-Share, which trades below the previous day’s levels at 29,916 points. On the levels of the eve the FTSE Italia Mid Cap (-0.09%); as well as, it consolidates the levels of the eve the FTSE Italy Star (-0.16%).

Between best Italian stocks large-cap, sustained Saipem, with a decent gain of 3.19%. It’s moving modestly up Stellantis, showing an increase of 1.12%. Positive balance for Italgas, which boasts an increase of 1.01%. Basically tonic A2Awhich records a capital gain of 0.87%.

The worst performances, however, are recorded on Telecom Italy, which gets -2.49%. Sales on Iveco, which records a drop of 2.09%. Bad sitting for Unicredit, which shows a loss of 2.06%. Under pressure BPM deskwhich shows a drop of 1.95%.

Between best stocks in the FTSE MidCap, MPS Bank (+7.88%), Italmobiliare (+4.29%), Cementir Holding (+3.01%) and Dry (+2.31%).

The worst performances, however, are recorded on SOL, which gets -2.23%. Slack Luve, which shows a small decrease of 1.43%. Modest descent for Soul Holding, which drops a small -1.42%. Thoughtful Zignago Glasswith a fractional decline of 1.39%.

Among macroeconomic appointments which will have the greatest influence on the performance of the markets:

Monday 02/20/2023

4:00 pm European Union: Consumer confidence (expected -19 points; previous -20.9 points)

Tuesday 02/21/2023

01:30 Japan: Manufacturing PMI (previously 48.9 points)

10am European Union: PMI services (expected 51 points; previous 50.8 points)

10am European Union: Manufacturing PMI (exp. 49.3 points; previous 48.8 points)

10am European Union: Composite PMI (expected 50.6 points; previous 50.3 points).