(Finance) – Bad day for Piazza Affari and the other main European stock exchanges. On the markets of the Old Continent, caution reigns, waiting to know the decisions of the ECB and to understand how the Nasdaq will open in the afternoon after the collapse of Facebook after market closing. The Monetary Policy Committee (MPC) of the Bank of England (BOE) voted with a majority of 5-4 to raise referral rates by 0.25 percentage points to 0.5%. On the front macroeconomic, PMI indices indicated that the Eurozone economy confirmed a slight slowdown in early 2022, while Eurozone producer prices increased again.

Day full of quarterly in Europe: Roche expects slower sales growth in 2022 with lower demand for Covid tests; soaring oil and natural gas prices boosted the performance of Shell; the recurring profit of BBVA it was the highest in the last ten years; ING saw a jump in profit on rising commissions and loans.

Substantially stable theEuro / US dollar, which continues the session on the eve of the levels and stops at 1.129. Weak session forgold, which trades with a drop of 0.27%. Widespread sales on crude oil (Light Sweet Crude Oil), which continues the day at $ 87 a barrel.

Advance just a little spread, which rises to +138 basis points, showing an increase of 2 basis points, with the yield of the 10-year BTP equal to 1.41%.

Among the Euroland indices hesitates Frankfurt, with a modest downside of 0.51%, a slow day for London, which marks a decline of 0.29%, and small loss for Paris, which trades with a -0.27%.

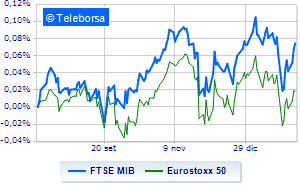

Weak session for the Milanese market, which trades with a drop of 0.35% on FTSE MIB, breaking the positive chain of three consecutive rises, which began last Monday; on the same line, depressed the FTSE Italia All-Share, which trades below the levels of the eve of 29.703 points.

Downhill the FTSE Italia Mid Cap (-1.22%); on the same trend, depressed the FTSE Italia Star (-1.59%).

At the top of the ranking of the most important titles of Milan, we find BPER (+ 1.16%), A2A (+ 1.09%), Italian post (+ 1.01%) e Banco BPM (+ 0.73%).

The worst performances, on the other hand, are recorded on Amplifon, which gets -2.64%.

Collapses STMicroelectronics, with a decrease of 2.43%.

Sales hands on Interpump, which suffers a decrease of 2.33%.

Under pressure Nexi, with a sharp decline of 2.10%.

At the top among Italian stocks a mid cap, GVS (+ 2.45%), LINE (+ 2.06%), Caltagirone SpA (+ 2.02%) e MPS Bank (+ 1.47%).

The worst performances, on the other hand, are recorded on Maire Tecnimont, which gets -5.58%.

Bad performance for Sesa, which recorded a drop of 3.71%.

Black session for Reply, which leaves a 3.41% loss on the table.

In free fall Brunello Cucinelli, which sinks by 2.89%.