The Unbearable Lightness of Being. Or the cemented conviction of being able to continue to challenge reality. Continue to push the limits, bury promises, stand on commitments, twist the steel of figures indefinitely. When it comes to public finances, Emmanuel Macron has made a mistake. No more than his predecessors, his supporters will retort. Certainly, but the Jupiterian president has multiplied the errors, sinned through naivety or cowardice, embraced the recipes of the past by clinging to the somewhat crazy dream of free money, forgetting that interest rates would not remain at zero forever. . He has made “whatever it takes” a numbing and addictive doctrine. And here is the Mozart of finance transformed into the David Copperfield of debt. Condemned today to serenade the rating agencies who are increasingly doubtful about the promises delivered.

France is up against the wall. On April 26, the two agencies Moody’s and Fitch should get the ball rolling, followed a month later by Standard & Poor’s. In January 2012, François Baroin, then Minister of the Economy, appeared on France 2’s 8 p.m. news to try to justify the loss of France’s famous triple A. “We have to put things into perspective and keep a lot of composure […]. It is not the rating agencies that make France’s policy,” he whispered. In fact, twelve years later, the country has not gone bankrupt and it is likely that in the event of a new sanction, the markets financial will not get carried away It is perhaps worse, as this deceptive calm brings us a little closer to the devastating storm every day.

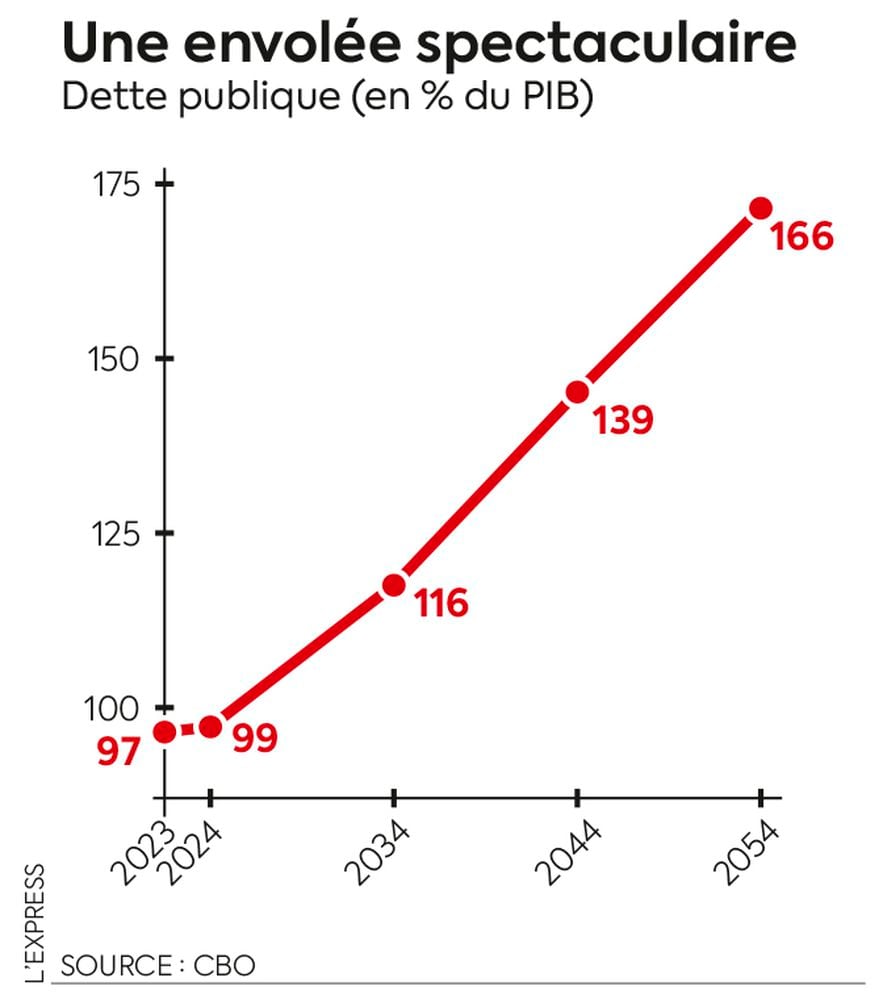

In seven years at the head of state, Emmanuel Macron’s record on the public finance front is overwhelming. Public debt rose from 98.2% of GDP in 2018 to 110.6% at the end of 2023. Behind this elusive ratio is 1,000 billion euros of additional debt, an unprecedented drift in a short period of time. such a short time. The deficit in public accounts – State, public authorities and social security organizations – reached 5.5% of GDP, compared to 2.3% in 2018, one of the worst performances in the euro zone, with the Italy as a traveling companion. Public spending, estimated at 56.7% of GDP at the end of 2023 according to the latest Bercy estimates, is almost 7 points higher than the average of our European partners. As for the rate of compulsory deductions, it is the highest of all the countries in the euro zone.

Anatomy of a budgetary drift.

© / Art Press

The State is large and omnipotent. One problem, one expense. A blocked roundabout, an emergency plan. A “nanny” state running to the slightest “Ought”, capable of creating a “repair” bonus to have socks mended. A State whose sovereign functions – education, security, health, justice – are failing, cannibalized by social protection which weighs nearly 33% of GDP (compared to 28% on average in the euro zone) but has not reduce poverty and no longer satisfy anyone. Certainly, during these seven years, France has suffered two major, unprecedented and unpredictable crises: the Covid-19 pandemic and the war in Ukraine, which caused an energy shock equivalent to that of 1973. So, yes, it has indeed The protective State had to play its role – and this is quite normal – during confinements: partial unemployment, loans guaranteed by the State, emergency aid plans and price shields when energy prices soared. .

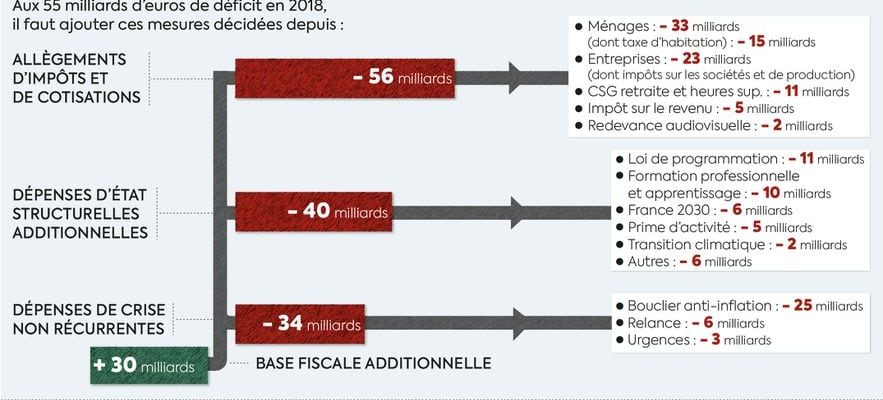

But is this really the only explanation for the tripling of the public deficit, which rose to 154 billion euros at the end of 2023 compared to 55 billion in 2018? To answer the question, L’Express asked a group of senior civil servants and former Bercy executives to delve into the figures and dissect the successive finance bills. Of the 154 billion holes in the public accounts recorded in 2023, 56 billion are attributable to reductions in taxes and contributions granted since 2018, 40 billion to structural and additional public expenditure such as the increase in the activity bonus decided in following the yellow vest crisis, measures on apprenticeship or professional training, and 33 billion, finally, for non-recurring crisis expenses… “The 2023 public deficit, 100 billion euros higher than that of 2018, is mainly explained by the permanence of deficits in social systems and by new interventions, excluding crisis expenditure,” conclude these experts. In summary, Covid and the war in Ukraine are on good terms.

No matter since government storytelling is well established. You just have to see how the stability program, in short the road map sent by France to Brussels, was put together. On paper, everything is under control: a public deficit reduced to 5.1% of GDP in 2024, 4.1% in 2026, 3.6% in 2026 and – magic of the figures – 2.9% in 2027, just below the famous 3% threshold engraved in stone in the Maastricht Treaty. To reduce the deficit, a program of cuts in public spending of 10 billion euros this year is planned, 20 billion next year, to which must be added, according to OFCE calculations, around fifteen billions each year by 2027. An “ambitious and realistic” plan, promises Bercy. On the menu this year: a reduction in transport costs reimbursed by Health Insurance or learning aid, a possible refocusing of the research tax credit, a call for contribution from local authorities.

“Lack of credibility, lack of consistency”

For the rest, it’s a big blur. “This stability program will have the same fate as all its predecessors, it will not be respected,” predicts François Ecalle, one of the finest public finance analysts, formerly of Bercy and the Court of Auditors. In the government’s mathematical equation, something is wrong. “We are being told of a budgetary adjustment with no effect on growth. Better yet, it would accelerate, reaching 1.8% in 2027,” explains Eric Heyer, director of the analysis department of the OFCE. “This is not very credible.” The global economy is gloomy and all European countries have the ambition to straighten out their accounts at the same time. “The risk is that growth will be weaker than expected, and therefore that revenues will be less dynamic, with ultimately a deficit higher than expected,” continues Eric Heyer. Lack of credibility, lack of consistency… In its latest report published on April 17, the High Council of Public Finances scrutinizes the government roadmap. At the heart of the problem: the clear cuts in spending announced until 2027. “Such an effort has never been made in the past and its documentation remains incomplete at this stage” tackles the High Council.

© / THE EXPRESS

“The review of public expenditure as it is carried out does not allow for change. We must put in place what I call a sunset clause. A large part of the expenditure voted on would be provisional and would only become permanent if an evaluation ex post proves their usefulness”, details Marc Ferracci, economist and Renaissance deputy. The situation is all the more perilous as the debt burden, that is to say the bill that the French State must pay each year to its creditors , should soar, according to Bercy’s estimates: a little more than 46 billion this year, 62 billion in two years and 72 billion in 2027… The equivalent of what the State spent last year for justice, security, higher education and research, and culture combined “We are entering a dangerous zone where real interest rates will once again become higher than the growth rates of the economy, which creates a. snowball effect on the debt and a risk of runaway”, worries Denis Ferrand, the general director of Rexecode.

Is a financial crisis possible in the short term? “It’s unlikely, because the European Central Bank is keeping an eye on it,” replies François Ecalle. In the panoply of instruments that the Frankfurt institution adopted in the aftermath of the great sovereign debt crisis in 2012, we find an almost unlimited debt buyback program. In the event of danger, the ECB would assume its role as savior of last resort. Unless a political shock encourages him to gain ground. And this is where the subject of debt once again becomes eminently political. What would happen in 2027 if, for example, the RN moved to the Elysée and rolled out its economic program with the return of the retirement age to 60 as a flagship and electoral measure? “The ECB could not support such a measure,” predicts the former auditor of the Court of Auditors. A dark scenario would follow, like that experienced by the United Kingdom two years ago: the short-lived Prime Minister Liz Truss was disembarked in forty-nine days after the publication of a delusional draft budget. and heavily sanctioned by the financial markets. No matter the magician, reality always ends up imposing itself.

.