The value of tomorrow is realized in partnership with Zonebourse.com

If you hate going to the dentist, the following lines may awaken some bad memories in you. Coltene manufactures all kinds of dental care accessories, from composites to rotary and drill torture instruments, saliva rollers, electrosurgical devices, composite veneers and other cleaning and scaling systems. In all, more than 50 different products ranging from the basic, such as headrest covers, to the most sophisticated, such as electrosurgery or disinfection devices.

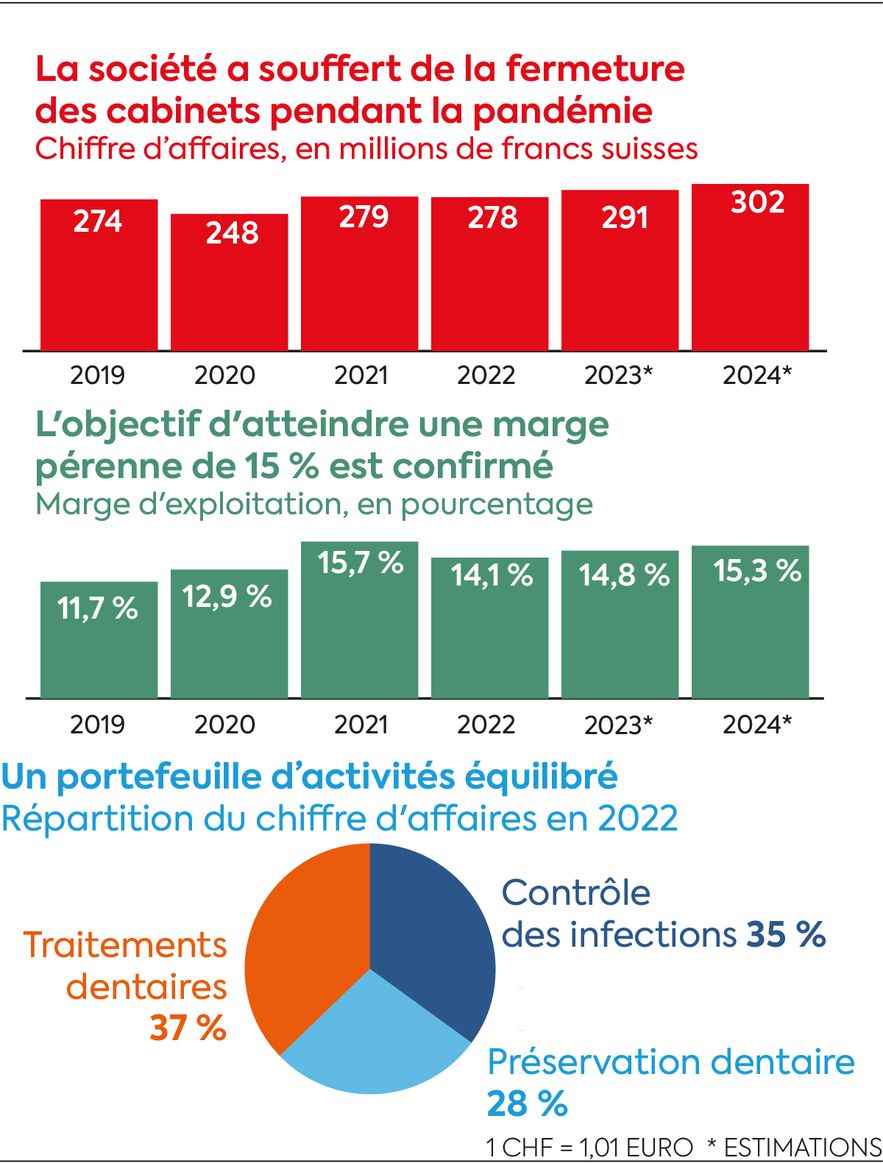

The Swiss company based in St. Gallen, a city of the same name in the eastern canton of the Confederation, became independent fifteen years ago by leaving the bosom of another listed company, Gurit. In the meantime, it separated from its non-dental medical activity and became considerably internationalized through external growth. In the United States and Brazil in particular. The scope currently generates a turnover of slightly less than 280 million Swiss francs (approximately 284 million euros), broken down as follows: 35% in infection control solutions, 37% in dental treatments and 28% in dental preservation. Geographically, 50% of receipts come from the North American market, 35% from Europe and the rest from third-party markets.

The dental market is benefiting from a fundamental trend made up of improved access to care and the aging of the population, with new opportunities that are on the rise, particularly in the aesthetic field. But that doesn’t mean Coltene is a growth stock. Its activity is tied to the dental care market, whose average annual growth has been slightly less than 5% for some time. This is more or less the pace of progress of the company, which strives to strengthen the dynamic by regularly making acquisitions. The integration process looks well-oiled and is maintaining a double-digit operating margin. Over the past ten years, this margin has averaged 13.5%. Management has maintained it around 14% in 2022, despite the turmoil in the supply chain, and plans to do the same over the following years, aiming for 15% eventually. Valuation multiples are pretty decent, especially since the bubble that inflated until 2021 burst.

Infographics

© / Dario Ingiusto / L’Express

Proximity to its customers

At Coltene, the ambitions are reasonable, like the management. Net debt is steadily declining. It should decline from 37 million euros in 2019 to less than 7 million euros in 2024, unless acquisitions come into play. But with a steady rise in free cash flow generation – it reached 23 million euros in 2021 – management has plenty to see ahead. In the same vein, we find in the capital a hard core of shareholder managers formed around the Huber, Zwingenberger and Rauch families, which is often the guarantee of thoughtful asset management.

In a dental market where practitioners are rather conservative, and therefore attached to brands they know well, Coltene relies heavily on proximity to its customers to maintain its positions. The other side of the coin is that market share gains are not always easy, so you have to regularly explore new horizons. This is the reason why the company is seeking to develop in Asia and more particularly in China, where it has rolled out an ambitious system. It has also positioned itself on the digital dimension of its business, to provide new solutions related to the Internet of Things for example, and to offer technological devices with greater added value.

Coltene is therefore a fine niche player and a recognized supplier in a sector with strong medical connotations, with a marked innovative dimension.

Infographics

© / Dario Ingiusto / L’Express