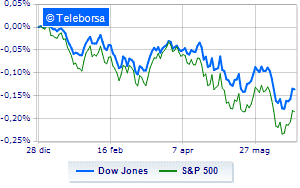

(Finance) – Wall Street remained essentially stable, continuing the session on the eve of the evewith the Dow Jones which stops at 31,525 points; on the same line, theS & P-500 (New York), which is positioned at 3,911 points, close to the previous levels. Below parity the Nasdaq 100, which shows a decline of 0.46%; consolidates the levels of the eve of theS&P 100 (-0.16%). Investors continue to try to understand if the market has hit rock bottom or whether the recent rebound will be short-lived. Inflation data and central bank decisions remain to affect sentiment, which could push several countries into recession.

On the macroeconomic front, they increased beyond expectations orders for durable goods Americans in May 2022. They increased, against expectations for a decrease, the sales of houses in progress in the United States. Factory activity in the Dallas District slowed in June 2022.

As for company announcements, GE announced that the CEO Larry Culp will also lead the Aviation Division after the division of the US giant into three companies. McDonald’s communicated that Ian Borden will be the new CFOwithin a series of changes at the top.

Significant upside in the S&P 500 for the sub-funds power (+ 2.74%), utilities (+ 0.80%) e sanitary (+ 0.67%). Among the worst on the list of the S&P 500 basket, the sectors showed the greatest decline telecommunications (-0.97%), materials (-0.76%) e secondary consumer goods (-0.66%).

Between protagonists of the Dow Jones, United Health (+ 2.92%), Chevron (+ 2.25%), Merck (+ 1.79%) e Caterpillar (+ 1.15%).

The strongest falls, on the other hand, occur on Boeingwhich continues the session with -2.82%.

Letter on Salesforcewhich recorded a significant decline of 2.14%.

Goes down Nikewith a drop of 2.01%.

Suffers DOWwhich shows a loss of 1.75%.

Between best performers of the Nasdaq 100, Qualcomm (+ 3.23%), Old Dominion Freight Line (+ 2.06%), NetEase (+ 1.99%) e Exelon (+ 1.76%).

The strongest falls, on the other hand, occur on Lucidwhich continues the session with -5.00%.

Collapses Electronic Artswith a decrease of 4.87%.

Sales hands on Oktawhich suffers a decrease of 3.22%.

Bad performance for Zscalerwhich recorded a decline of 3.20%.

Between the data relevant macroeconomics on US markets:

Monday 27/06/2022

14:30 USA: Durable goods orders, monthly (expected 0.1%; previous 0.4%)

4:00 pm USA: Home sales in progress, monthly (expected -3.7%; previous -4%)

Tuesday 28/06/2022

14:30 USA: Wholesale stocks, monthly (previous 2.1%)

15:00 USA: S&P Case-Shiller, annual (expected 21%; previous 21.2%)

15:00 USA: FHFA house price index, monthly (previous 1.5%).