(Finance) – Negative session for Wall Street, under pressure from the rise in oil prices with fears in the Middle East and the risk of an escalation. The issue of inflation trends and the next moves by central banks on monetary policy remains under the spotlight. The publication of the Federal Reserve’s Beige Book is arriving in the evening.

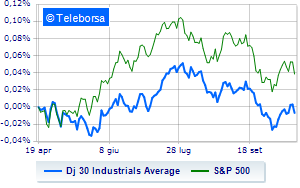

Among US indices, the Dow Jones it is leaving 0.72% on the floor, thus ending the bullish trail supported by three consecutive gains, which began last Friday; on the same line, theS&P-500, which slips to 4,328 points. In red the Nasdaq 100 (-1%); as well, downhill theS&P 100 (-0.95%).

Positive result in the S&P 500 basket for the sector power. In the list, the worst performances are those of the sectors materials (-2.34%), secondary consumer goods (-1.94%) e industrial goods (-1.83%).

Among the best Blue Chips of the Dow Jones, Procter & Gamble (+1.87%), McDonald’s (+1.66%), Boeing (+0.94%) e Chevron (+0.88%).

The strongest sales, however, occur at Walgreens Boots Alliancewhich continues trading at -4.95%.

Goes down Caterpillarwith a decline of 3.89%.

Prey for sellers Johnson & Johnsonwith a decrease of 2.33%.

They focus on sales Goldman Sachswhich suffers a decline of 2.02%.

Between protagonists of the Nasdaq 100, DexCom (+4.09%), Palo Alto Networks (+1.06%), Mondelez International (+1.02%) e Diamondback Energy (+0.97%).

The worst performances, however, are recorded on Polishedwhich gets -8.28%.

Collapses Astrazenecawith a decline of 5.90%.

Sales galore Walgreens Boots Alliancewhich suffers a decrease of 4.95%.

Bad performance for Illuminatewhich recorded a decline of 4.75%.