(Tiper Stock Exchange) – Wall Street moves higher, after a measure of inflation – closely watched by the US central bank – cooled down in May, offering new evidence that price pressures were easing due to the Federal Reserve’s aggressive interest rate hikes. The personal consumption expenditures price index in fact, it increased by only 0.1% on a monthly basis and by 3.8% on a year, marking thesmallest increase in more than two years.

Always on macroeconomic front, personal consumption increased less than expected in May, while personal income increased more than expected. US consumer confidence rose in June, according to the latest survey conducted by the University of Michigan.

Between quarterly spread before the opening of the market, Nike reported declining earnings and a disappointing outlook, while Constellation Brands reported results beyond expectations.

From the world of private equityit turned out that kkr extension has improved the offer to acquire CIRCUM (after another offer from Arcline Investment Management had arrived), and that Apollo Global Management announced its intention to launch a takeover bid on the Spanish Applus Services.

Among the interesting titles come on analysts’ ratings, Carnival benefit from Jefferies upgrade to “buy” from “hold”, e Apple Citi’s initiation of coverage with a “buy” recommendation and a target price of $240 per share.

Own Apple has passed the $3 trillion market cap mark. The Cupertino company had been the first company to reach this market capitalization during a session in January 2022, but it had failed to close the day at that level.

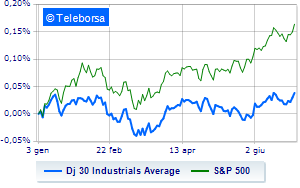

Looking to main indicesThe Dow Jones is up 0.73%; along the same lines, theS&P-500 the day continues with an increase of 1.14%. Rev up the NASDAQ 100 (+1.6%); with the same direction, climbs theS&P 100 (+1.25%). Informatics (+1.71%), secondary consumer goods (+1.39%) and telecommunications (+1.24%) in good light on the S&P 500 list.

Between protagonists of the Dow Jones, Apple (+1.60%), Microsoft (+1.54%), Wal-Mart (+1.39%) and JP Morgan (+1.32%).

The strongest sales, on the other hand, show up Nikewhich continues trading at -2.31%.

Between protagonists of the Nasdaq 100, Enphase Energy (+4.89%), Align technology (+3.58%), Nvidia (+3.28%) and AirBnb (+3.22%).

The worst performances, however, are recorded on Old Dominion Freight Line, which gets -2.37%. Disappointing Micron Technology, which lies just below the levels of the eve. Slack Autodeskwhich shows a small decrease of 0.52%.