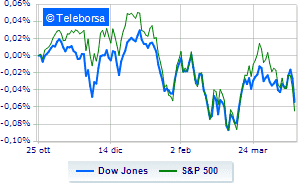

(Finance) – Black day for the New York Stock Exchange, which sinks with a descent of 1.74%; along the same line, theS & P-500, which continues the session at 4.312 points. Depressed the Nasdaq 100 (-1.79%); with a similar direction, theS&P 100 (-1.78%). In addition to several disappointing quarterly reports and the rise in bond yields, it is the “hawkish” comments of central bank officials. The chairman of the Federal Reserve Jerome Powell he said yesterday that a 50 basis point hike in interest rates “will be on the table” at the next monetary policy meeting scheduled for May 3 and 4.

“It’s hard not to dwell on the Fed’s Bullard comments suggesting that a 75 basis point rate hike would not be out of the question in May,” said Sebastien Galy, Nordea Asset Management Senior Macro Strategist. Federal Reserve is still trying to gain control of the inflation dynamics on Wall Street but, more importantly, in the real economy. He has yet to do it, but he will likely prevail by anticipating the tightening as Jerome Powell suggested on Thursday when he confirmed that 50bp is scheduled for the May meeting. “

Meanwhile, the quarterly of large companies. Kimberly-Clarka giant in the paper products sector, posted an above-expected quarterly report in a context described as “volatile and inflationary”. American Expressactive in financial and travel services, saw its financial performance driven by travel and entertainment spending. Verizon Communicationsa US broadband and telecom provider, said it expects financial results for 2022 at the low end of its previously provided guidance.

Downhill to Wall Street all compartments of the S&P 500. In the lower part of the ranking of the S&P 500, significant falls are manifested in the sectors telecommunications (-3.17%), materials (-3.06%) e sanitary (-2.92%).

Bad day for all the Dow Jones Blue Chips, which show a negative performance.

The strongest falls occur on Verizon Communicationwhich continues the session with -6.21%.

Thud of Caterpillarwhich shows a fall of 4.39%.

Letter on Nikewhich records a significant decline of 3.35%.

Goes down Salesforcewith a decrease of 2.75%.

Between protagonists of the Nasdaq 100, NetEase (+ 2.77%), Electronic Arts (+ 2.31%), JD.com (+ 2.17%) e Constellation Energy (+ 1.29%).

The strongest sales, on the other hand, show up on Intuitive Surgicalwhich continues trading at -13.22%.

Collapses Dexcomwith a decrease of 5.75%.

Sales hands on Align Technologywhich suffers a decrease of 4.96%.

Bad performance for Alphabetwhich recorded a decline of 3.86%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Friday 22/04/2022

15:45 USA: Manufacturing PMI (expected 58.2 points; preceding 58.8 points)

15:45 USA: PMI services (expected 58 points; precedent 58 points)

15:45 USA: Composite PMI (expected 57 points; preceding 57.7 points)

Tuesday 26/04/2022

14:30 USA: Durable goods orders, monthly (1% expected; previous -2.2%)

15:00 USA: FHFA house price index, monthly (previous 1.6%).