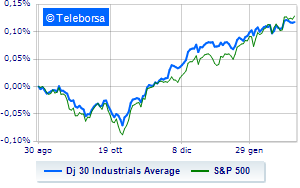

(Finance) – Wall Street continues to trade moderately higherafter drawing benefit from inflation datawhich confirms signs of a slowdown and heralds a possible rate cut by the Fed. Il Dow Jones stops at 38,938 points, while theS&P-500 it makes a small leap forward of 0.36%, reaching 5,088 points. On the rise Nasdaq 100 (+0.72%); on the same line, in fractional progress theS&P 100 (+0.34%).

In the S&P 500, the sectors performed well informatics (+0.87%), materials (+0.74%) e power (+0.54%). The sector healthcarewith its -0.53%, is the worst of the market.

Between protagonists of the Dow Jones, Intel (+2.05%), Salesforce (+1.87%), Honeywell International (+1.56%) e Dow (+1.22%).

The worst performances, however, are recorded on Boeingwhich obtains -1.81%.

Modest descent for Goldman Sachswhich drops a small -1.44%.

Thoughtful Wal-Martwith a fractional decline of 1.29%.

He hesitates United Healthwith a modest decline of 1.10%.

To the top between Wall Street tech giantsthey position themselves Advanced Micro Devices (+7.35%), Monster Beverage (+5.53%), Marvell Technology (+5.12%) e ON Semiconductor (+2.74%).

The worst performances, however, are recorded on Xcel Energywhich gets -8.17%.

They focus on sales Modernwhich suffers a decline of 3.26%.

Sales up GE Healthcare Technologieswhich recorded a decline of 2.83%.

Negative session for Constellation Energywhich shows a loss of 2.64%.

Among macroeconomic events which will have the greatest influence on the performance of the US markets:

Thursday 29/02/2024

2.30pm USA: Personal income, monthly (expected 0.4%; previously 0.3%)

2.30pm USA: Jobless Claims, weekly (expected 209K units; previously 202K units)

2.30pm USA: Personal expenses, monthly (expected 0.2%; previously 0.7%)

3.45pm USA: Chicago PMI (expected 48.1 points; previously 46 points)

4:00 pm USA: Home sales in progress, monthly (expected 1.4%; previously 5.7%).