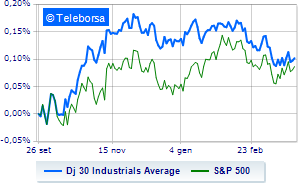

(Finance) – Wall Street was substantially stable, continuing the session at the levels seen on the previous day, with Dow Jones which stops at 32,069 points; on the same line, colorless theS&P-500, which continues the session at 3,946 points, on the same levels as before. Slightly negative the NASDAQ 100 (-0.42%); without direction theS&P 100 (-0.18%).

American stock markets started the last session of the week down following the weakness of the European markets, albeit with more limited declines, on the return of tensions in the banking sector. This was despite overseas reassurances from Treasury Secretary Janet Yellen that banking regulators and the Treasury are prepared to provide guarantees on other banks’ deposits, as they have done with failed Silicon Valley Bank and Signature Bank. . Lenders therefore remain under special observation after two German banks yesterday announced that they will not exercise the call option on one of their AT1 bonds.

The sectors are distinguished in the S&P 500 basket utilities (+2.06%), office consumables (+1.30%) and sanitary (+0.79%). In the price list, the sectors secondary consumer goods (-0.96%), informatics (-0.59%) and financial (-0.56%) are among the best sellers.

To the top between Wall Street giants, Amgen (+2.04%), Coca Cola (+1.72%), Procter & Gamble (+1.61%) and cisco systems (+1.39%).

The strongest sales, on the other hand, show up Walt Disneywhich continues trading at -2.13%.

Under pressure American Expresswith a sharp drop of 1.65%.

Slack JP Morganwhich shows a small decrease of 1.39%.

Modest descent for Caterpillarwhich drops a small -1.33%.

On the podium of the Nasdaq stocks, Activision Blizzard (+5.26%), Intuitive Surgical (+3.82%), Sirius XM Radio (+3.60%) and American Electric Power Company (+3.23%).

The worst performances, however, are recorded on Pdd Holdings Inc. Sponsored Adrwhich gets -5.31%.

Black session for Enphase Energywhich leaves a loss of 5.11% on the table.

At a loss Datadogwhich drops by 4.87%.

Heavy Lam Researchwhich marks a drop of -3.93 percentage points.

Among the data relevant macroeconomics on US markets:

Friday 03/24/2023

1.30pm USA: Durable goods orders, monthly (exp. 0.6%; previous -5%)

2.45pm USA: PMI services (expected 50.5 points; previous 50.6 points)

2.45pm USA: Manufacturing PMI (exp. 47 points; previous 47.3 points)

2.45pm USA: Composite PMI (expected 47.5 points; previous 50.1 points)

Tuesday 03/28/2023

2.30pm USA: Wholesale inventories, monthly (previously -0.4%).