(Tiper Stock Exchange) – Little moved session for Wall Streetwith investors who await the quarterly reports of the technological giants. During this week they disseminate the data alphabet (parent company of Google), Amazon And Meta Platformsbut also other multinationals such as intel, Mondelez International, ExxonMobil And MasterCard.

Between numbers arrived todaythose of stand out Coca Colawhich registered a first quarter beyond expectations despite the price increase it implemented on its products.

As for the corporate announcements, Eli Lilly has signed an agreement to sell a drug to Amphastar in a $1 billion deal, while Disney has begun its second wave of layoffs (bringing total job cuts in recent weeks to 4,000 by the time this round is completed).

Between titles under observation There are Credit Suissewhich recorded asset outflows of CHF 61.2 billion in the first quarter of 2023, and Bed Bath & Beyondwhich filed for Chapter 11 bankruptcy after it failed to secure the funds it needed to continue operating.

On the front of analyst recommendation, First Solar suffers the downgrade of Citi to Sell from Neutral, PPG Industries benefits from JPMorgan upgrade to Overweight from Neutral e Kingsoft Cloud accuses a downgrade of Goldman Sachs to Sell from Neutral.

I’m not here today important data in the calendar. Among the few insights, the FED Chicago National Activity Index (CFNAI) remained at -0.19 points in March 2023.

From a macro point of view, analysts highlight Intesa Sanpaolo, this week the focus it will be on the March consumption deflator and on the 1st quarter Employment Cost Index, “which should confirm the pressures on services prices and labor costs”. March personal spending and April consumer confidence are expected to decline modestly, while personal income, new home sales and durable goods orders are expected to edge up marginally.

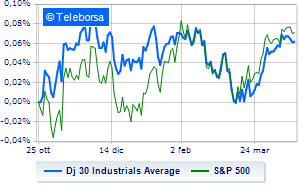

Basically stable Wall Streetwhich continues the session on the previous levels, with the Dow Jones which stops at 33,824 points; along the same lines, moves around parity theS&P-500, which continues the day at 4,139 points. Fractional earnings for the NASDAQ 100 (+0.26%); almost unchanged theS&P 100 (+0.16%).