(Finance) – Wall Street ignored Jerome Powell’s attempt to curb bets on interest rate cuts and continued to rise, they begin December with the same positive sentiment with which they closed an exceptional November, in which the 9% return of the S&P 500 index represented the seventh best month of returns in the last 100 years.

The Federal Reserve chairman said he believed it was “premature to conclude with confidence that we have reached a sufficiently restrictive stance, or to speculate about when policy might ease” and that the Fed is prepared “to further tighten policy if that proves appropriate.” However, the market seems to have focused on this phrase: “The strong actions we have taken have moved our key rate well into restrictive territory“.

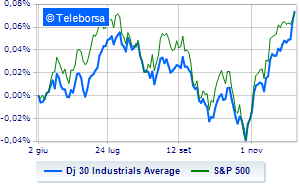

Looking at the main indicesThe Dow Jones it is up by 0.84%, continuing the series of four consecutive increases that began last Tuesday; along the same lines, theS&P-500 proceeds in small steps, advancing to 4,599 points. Fractional earnings for the Nasdaq 100 (+0.4%); on the same trend, with a moderate increase inS&P 100 (+0.34%).

Highlighted on the North American S&P 500 i compartments power (+1.56%), industrial goods (+1.50%) e materials (+1.34%).

To the top between giants of Wall Street, Salesforce (+4.11%), Walgreens Boots Alliance (+2.61%), Nike (+2.05%) e Caterpillar (+2.00%).

The strongest sales, however, occur at Intel, which continues trading at -2.13%. Prey for sellers Wal-Mart, with a decrease of 1.65%. Moderate contraction for Microsoft, which suffers a decline of 1.31%. Undertone Procter & Gamble which shows a filing of 0.51%.

Between best performers of the Nasdaq 100, Illuminate (+7.65%), Warner Bros Discovery (+7.37%), Polished (+5.92%) e AirBnb (+5.47%).

The steepest declines, however, occur at Marvell Technology, which continues the session with -5.10%. They focus on sales Intel, which suffers a decline of 2.13%. Sales up PDD Holdings, which recorded a decline of 1.66%. Disappointing CrowdStrike Holdingswhich lies just below the levels of the day before.