(Tiper Stock Exchange) – Wall Street moves higherafter that inflation showed further signs of cooling in June, according to a much-watched indicator from the Federal Reserve. Notably, data showed that the US inde core PCE price rose at an annualized rate of 4.1% in June, up from 4.6% the previous month. In addition, US labor costs increased in the second quarter at their slowest pace in two years, reflecting a gradually cooling labor market.

Incorporating the Fed rate hike and the possibility that the trail may be winding down, the investors are paying attention to the company earnings which, overall, are delivering a picture of still resilient earnings. Among the titles that have released satisfactory results is intelwhich posted a surprise profit, saying the decline in sales of its major personal computer chips in the second quarter wasn’t as steep as expected.

In the energy sector, ExxonMobil reported lower-than-expected profits in the second quarter, hit by a decline in natural gas prices, while Chevronssaid its annual production forecast is near the low end of its previously estimated range.

Among the other giants that have communicated financial data, Procter & Gamble beat earnings and revenue expectations in the recent quarter, while Ford Motor it beat estimates and raised its guidance, while noting that EV adoption is taking longer than expected.

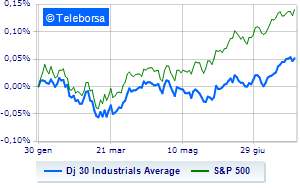

Looking to main indicesThe Dow Jones shows an increase of 0.65%; along the same lines, positive performance forS&P-500, which continues the day with an increase of 1.05% compared to the close of the previous session. Significant improvement NASDAQ 100 (+1.91%); along the same lines, in cash theS&P 100 (+1.33%). Telecommunications (+2.57%), secondary consumer goods (+1.83%) and informatics (+1.56%) in good light on the S&P 500 list.

To the top between Wall Street giants, intel (+6.82%), Procter & Gamble (+2.70%), Microsoft (+2.47%) and boeing (+2.14%).

The worst performances, however, are recorded on Walgreens Boots Alliance, which gets -2.66%. Decided decline for cisco systems, which marks a -1.65%. It moves below parity Chevrons, showing a decrease of 0.59%. Moderate contraction for United Healthwhich suffers a drop of 0.59%.

To the top between Wall Street tech giantsthey position themselves polish (+7.32%), intel (+6.82%), JD.com (+6.58%) and Sirius XM Radio (+5.72%).

The worst performances, however, are recorded on Enphase Energy, which gets -9.18%. Under pressure Charter Communications, with a sharp drop of 2.67%. He suffers Walgreens Boots Alliance, which shows a loss of 2.66%. Prey of sellers cisco systemswith a decrease of 1.65%.