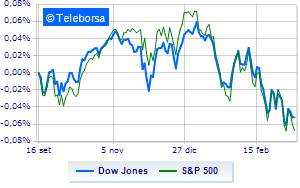

(Finance) – Plus sign for the US price listwith the Dow Jones up by 1.10%; on the same line, theS & P-500 the day continues with an increase of 1.30%. Effervescent the Nasdaq 100 (+ 2.04%); as well as, excellent performance of theS&P 100 (+ 1.54%). The oil prices continued to fall, with the resumption of Covid-19 cases in China that could have an effect on the world’s largest crude oil importer. Meanwhile, OPEC has said that inflation and the conflict in Ukraine are putting oil demand at risk. “There is some respite todayin the sense that oil prices are collapsing and the markets are reacting positively, “said Todd Lowenstein, chief equity strategist of The Private Bank at Union Bank.” There seems to be oversold and the move looks extreme in the short term, but it is also proportional to the events that took place previously “, he added.

On macroeconomic frontAnother surge in energy prices has pushed producer prices to their largest monthly rise, according to data from the Department of Labor. The Empire State manufacturing index in New York collapsed against expectations for a recovery.

Secondary consumer goods (+ 2.47%), Informatics (+ 2.26%) e consumer goods for the office (+ 1.61%) in good light on the S&P 500 list. The sector powerwith its -3.79%, it is the worst of the market.

Among the best Blue Chips of the Dow Jones, Procter & Gamble (+ 3.35%), Walt Disney (+ 3.28%), McDonald’s (+ 3.01%) e Microsoft (+ 2.58%).

The strongest sales, on the other hand, show up on Chevronwhich continues trading at -5.21%.

At a loss DOWwhich drops by 3.23%.

Between protagonists of the Nasdaq 100, Marvell Technology (+ 7.68%), Nvidia (+ 6.47%), Advanced Micro Devices (+ 6.10%) e JD.com (+ 5.85%).

The strongest falls, on the other hand, occur on Baiduwhich continues the session with -2.40%.

It slips Modernwith a clear disadvantage of 1.97%.

In red Workdaywhich shows a marked decrease of 1.32%.

Undertone Dollar Tree which shows a filing of 0.79%.

Between the data relevant macroeconomics on US markets:

Tuesday 15/03/2022

13:30 USA: Empire State Index (expected 7 points; preceding 3.1 points)

13:30 USA: Production prices, monthly (expected 0.9%; previous 1.2%)

13:30 USA: Production prices, annual (expected 10%; previous 10%)

Wednesday 16/03/2022

13:30 USA: Retail sales, monthly (expected 0.4%; previous 3.8%)

13:30 USA: Retail sales, annual (previous 13%).