(Finance) – Terna announced, on June 13, that it had purchased, from June 6 to 9, 2022, a total of 546,650 ordinary shares, for an equivalent value of 4,231,661.83 euros.

The transaction follows what was disclosed on May 26 last regarding the start of a buy-back program to service the 2022-2026 Performance Share Plan starting from May 27, 2022 as part of the aforementioned shareholders’ resolution, as well as to what was communicated on 6 June last.

As part of the Program, Terna therefore purchased 1,280,717 treasury shares (equal to 0.064% of the share capital) for a total value of 9,999,993.13 euros.

Consequently, the Program, launched on May 27, 2022Yes is concludedhaving reached the maximum amount of the same, as per press release of 26 May 2022

The overall shares purchased under the aforementioned Program are added to the additional 3,095,192 treasury shares already purchased by the Company in 2020 and 2021.

To date, therefore, Terna holds a total of 4,375,909 treasury shares (equal to 0.218% of the share capital) and the subsidiaries do not hold shares of the parent company Terna.

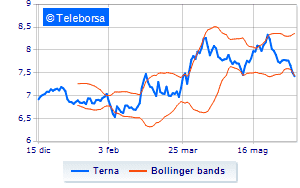

Meanwhile, in Milan, the operator of networks for the transmission of electricity slips and is positioned at € 7.336, with a decrease of 1.21%.