(Finance) – Tenaris closes 2021 with revenue $ 6.5 billion, up 27%, while Ebitda more than doubled to $ 1.35 billion.

The group reviews theusefulin the period, which stood at 1.05 billion against the loss of 642 million recorded in 2020.

In 2021 “our results strongly recovered from the worst effects of the pandemic, supported by the resumption of oil and gas drilling in the Americas and by the structural measures we have taken to improve our long-term profitability” – underlines Tenaris in the note of the accounts -.

The annual dividend proposed is $ 0.28 per share, which will be paid on May 25th.

Outlook

In the first half of 2022, Tenaris expects “further increases in sales thanks to higher prices in North America and deliveries to an offshore pipeline in Europe “. In the second quarter – reads the note -” we should see a significant recovery in sales in the Middle East and Africa. Despite the higher energy costs in Europe, ours EBITDA margin should continue to increase also in the first half of the year“.

The title Tenaris already in the first few minutes of trading, it ranks at the top of the main basket, changing hands with an increase of 2.91%.

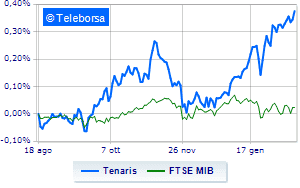

The stock analysis performed on a weekly basis highlights the uptrendline of the manufacturer of pipes for exploration and production of gas more pronounced than the trend of FTSE MIB. This expresses the greater attractiveness of the stock on the part of the market.

The short-term implications of Tenaris 12.29 Euro underline the evolution of the positive phase in the resistance area test. Possible a descent to the bottom 12.03. A strengthening of the curve is expected to test new targets 12.55.