The comparison can make you smile. A Nasdaq, in Europe? As a reminder, this stock market index has housed most of the world’s best-performing technology quotes since the early 1970s. It is now the second largest stock market in the United States. A showcase and the true pulse of global tech often imitated, never equalled. But in a spirit of sovereignty in vogue on the Old Continent, the European group Euronext (manager of the Paris, Milan and Oslo stock exchanges, among others), decided in mid-2022 to create the Tech Leaders index. The objective: to offer the same type of visibility to investors for its local champions. A year later, is success there?

Euronext announces, this Thursday, June 15, exclusively at L’Express, the entry of fifteen companies, led by the French group Edenred, also a newcomer to the CAC40. This is followed by the Belgian firm specializing in “cleantech” (clean technologies) Umicore, the Scandinavian media conglomerate Schibsted, the IT services company SII, but also the companies Aubay, Datalogic, FD Technologies… Enough to reach 122 listings on Tech Leaders , all over 200 million euros in capitalization. “The index is developing very well”, assures the chairman of the board of Euronext, Stéphane Boujnah. Despite some reservations.

The last twelve months, undermined by inflation and the uncertainties linked to the war in Ukraine, have neither favored the rise in share prices nor initial public offerings (or IPOs), which have become rather rare (-37% between 2021 and 2022 in Paris alone). A company particularly expected at the turn, Deezer, competitor of the Swedish giant Spotify, missed its entry, not arranging the affairs of Tech Leaders where it appears. On arrival, the overall capitalization of the tech segment exceeded 900 billion euros, a level slightly lower than that observed when it was launched. Far from the heights, in any case, reached by the Nasdaq-100 – no less than 15,500 billion dollars in capitalization -, driven since the beginning of the year by the spectacular promises of generative artificial intelligence (AI).

Still young

“The Tech Leaders index is a good initiative, but it is still young and lacks notoriety”, considers Alexandre Baradez, head of market analysis at the broker IG. Moreover, some entries look more like strategic repositionings of sure values than sensational conquests. Freelance.comnewcomer to Tech Leaders, listed since 2005, assumes: “We have long been classified in the human resources (HR) sector, we now consider ourselves to be a tech company thanks to services that are part of the revolution of Web3 and the Future of Work (future of work)”, confides Claude Tempe, its vice-president. Other companies highlight historical developments. “We are a fintech”, delivers Bertrand Dumazy, at the head of Edenred – on the stock market since 2010 -, and inventor of the paper restaurant ticket that can now be read in an electronic chip.”Euronext solicits this type of company because it has few new tech introductions to put in its mouth”, comments Franck Sebag, partner EY-Fabernovel , an expert in the financial markets, even less so flashy names that only the Nasdaq, kingdom of Gafam, can boast of.

Stéphane Boujnah remains confident. Tech Leaders has pretty locomotives like ASML, a specialist in semiconductors – nearly 270 billion in market capitalization alone -, Adyen in fintech or Ubisoft in video games. The good capacities of Europeans in fundamental research in AI, in the field of quantum as well as in NewSpace also give hope for the emergence of powerful tech players. A new momentum of IPOs” is looming, finally observes Stéphane Boujnah. Euronext already points to 24 listings in 2023 (including 6 in Paris). “There are always less than fundraising in the private sector”, regrets for the moment Franck Sebag The end of “magic money” could nevertheless breathe new life into IPOs.

© / Art Press

In France, the government still hopes to attract ten of its unicorns (companies valued over one billion euros) to listing by 2025. And this, even if the examples of Deezer, Believe and OVH have to date offered contrasting results. Bpifrance and the Caisse des dépôts will in particular mobilize 800 million euros to promote introductions. Other support measures and some regulatory flexibilities provided for by the European “Listing Act” should finally make IPOs more attractive, easier and safer. There will be nuggets to seduce. The latest report “The Titans of Tech 2023”, by GP Bullhound, published yesterday, lists several dozen start-ups likely to become unicorns in the next two years in Europe.

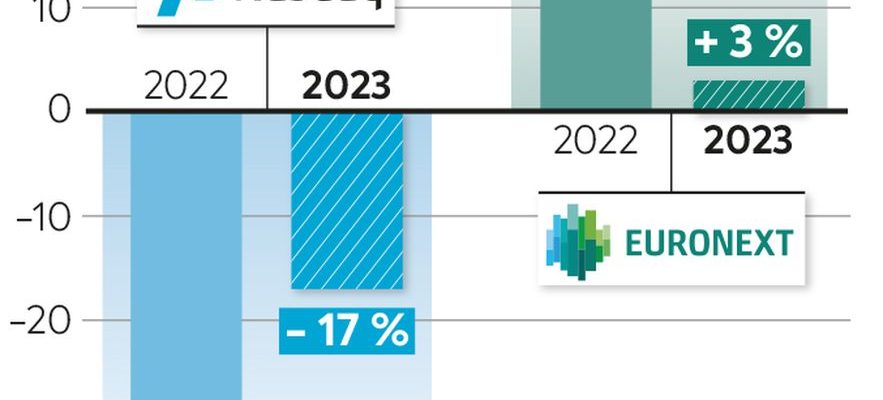

Euronext is perhaps well placed to welcome them. Due to its leadership: its main competitor, the London Exchange Stock (LES), has for example only 10 IPOs in 2023, and the Frankfurt Stock Exchange only one. Its leader even praises a certain resistance to its American model. “After an introduction, the evolution of prices at Euronext is on average much higher than that of the Nasdaq”, continues Stéphane Boujnah, figures in support (even our infographic). “The group is the only one that has the technical and communication capacities to develop a continental equivalent to the Nasdaq”, abounds Alexandre Baradez. Euronext came out of a very solid year, increasing its revenues by nearly 10%. Reappointed for a third term of four years, Stéphane Boujnah has a rather positive balance sheet, with a fourfold increase in the company’s market capitalization since 2015. “The offer must continue to be significant, and the demand will follow “, forward, confident, Bertrand Dumazy, about Tech Leaders. In short, allow yourself time to grow.