More than 4 million French people benefit from it every year.

This is a point that is often overlooked when it comes to taxes. If we commonly talk about the income tax return, the title of the form does not suggest that the tax authorities also take into account expenses incurred throughout the year. However, this is an important part to complete, making it possible to reduce the amount to be paid to the General Directorate of Public Finances (DGFiP).

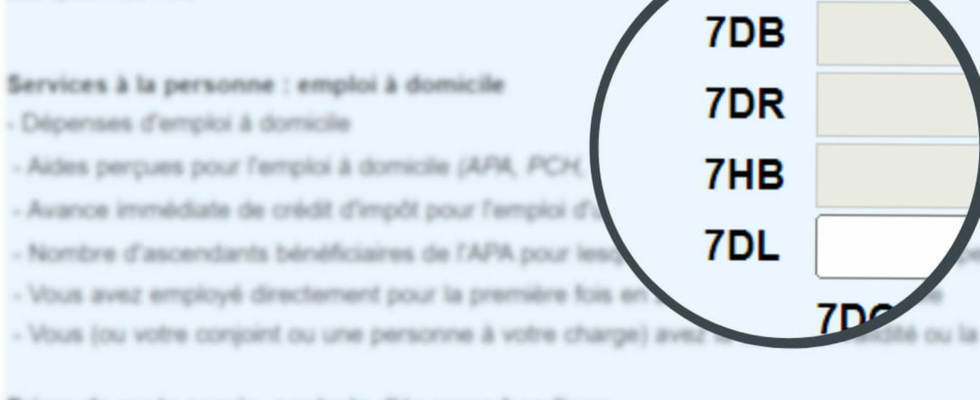

Various schemes exist but one line can particularly reduce the bill drastically: it is possible to deduct up to 6,000 euros from the total tax payable using box 7DB. This concerns many French people. 4.5 million of them fill it out each year. On average, this offers a reduction of 1200 euros on the tax bill.

This box concerns the tax reduction to which you are entitled if you used a personal service during the year 2023. This may have taken various forms: cleaning lady, childcare at home , assistance for the elderly or disabled, DIY work, gardening, IT assistance, pet walking, etc.

So, if you have hired someone to look after your children for a few hours a week, to clean/iron your home or to maintain your green spaces, you have the right to enter this or these expenses. in this box: the State covers part of it, by lowering the amount of your tax.

To find box 7DB, you must go to your personal tax space, open your online declaration and go to the second page entitled “Your charges” by clicking on “Next”. Further down, line 7DB “Personal service: employment at home” appears. Then just click on the pencil. A window will then appear, asking you to detail the expenses you have had as well as the aid you may have received. Then, just validate. The calculation will be done automatically and the result will be reported on the last page of your declaration, before validation.

For a declaration without children, the maximum amount taken into account can be 12,000 euros in total and offers a tax reduction of 6,000 euros, or 50% of the costs incurred. The ceiling is increased to an additional 1,500 euros per dependent child (13,500 euros for a declaration with one child, 15,000 euros with two children, etc.) and the reimbursement offered is still 50%. This is the tax credit most used by the French.