It’s a dizzying total. In 2023, global tax evasion will reach the sum of 1000 billion dollars according to the European Tax Observatory. To get an idea, this sum corresponds to the GDP of the Netherlands, or almost twice the turnover of the American retail titan Walmart, the world’s largest company.

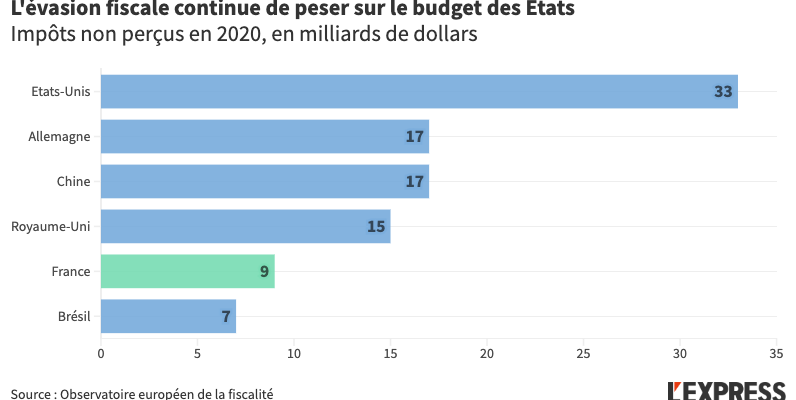

This shortfall for States exploded on the threshold of the 21st century. From a little more than 1.5% of tax revenues at the end of the 1980s, it rose to almost 10% in 2022. With 9 billion dollars lost in 2020 alone, France is one of the countries most affected, behind the United States with 33 billion dollars in uncollected taxes, Germany and China (17 billion) and the United Kingdom (15 billion)*.

Among the destinations most popular with companies wishing to avoid direct debits, the Netherlands comes first, closely followed by Ireland and Switzerland. Next come the British Virgin Islands, Puerto Rico and Singapore.

* Data as of 2020