Tag: tax

Entertainment giant Disney climbs in Florida – millions in tax advantage went up and fans got angry because the company didn’t condemn the law that licked minorities quickly enough

In Florida, a law was passed in March banning schools from dealing with sexual and gender minorities with children. Florida’s biggest employer was too quiet for fans. The gap between…

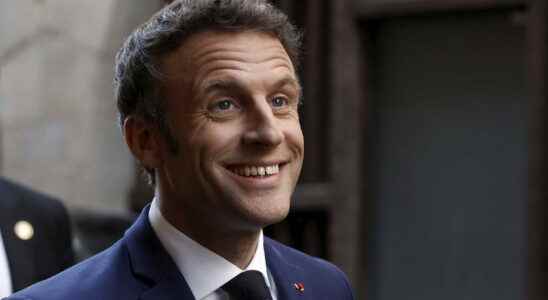

Prime Macron 2022: 6,000 euros net of tax this summer?

PRIME MACRON 2022. The PEPA premium should reach 6,000 euros this year. For who ? How it works ? All of the information. Summary [Mis à jour le 29 avril 2022 à…

Income tax 2022: how to correct my tax return?

2022 INCOME TAX. Forgot a little detail on your tax return? A tax error slipped in? Don’t panic, you can totally fix it. Manual. Summary [Mis à jour le 29…

2022 tax return date: the deadline to remember!

2022 TAX DEADLINE. Deadlines exist depending on your department of residence for completing your tax return. What is the online deadline? Paper ? We take stock. Summary [Mis à jour…

Income tax 2022: how to get a refund?

INCOME TAX 2022. It is entirely possible that the tax authorities will have to reimburse you for income tax. In which cases? How it works ? We tell you everything.…

2022 tax declaration date: what deadline in your department?

2022 TAX DEADLINE. Don’t be surprised, deadlines exist for filing your tax return. They vary according to your department of residence. Summary [Mis à jour le 28 avril 2022 à 08h03] The…

Prime Macron 2022: should I mention it on my tax return?

MACRON BONUS 2022. The exceptional purchasing power bonus should reach 6,000 euros this year. But do you have to declare it to taxes? Our lighting. Summary [Mis à jour le…

Income tax 2022: how to calculate it according to your bracket?

INCOME TAX 2022. The calculation of your income tax is based on a scale, and a bracket depending on your salary. Which slice for you? How to calculate? How much…

2022 tax declaration date: what deadline? The calendar !

DEADLINE TAXES 2022. The declarative campaign has been open since April 7, some only have a few weeks left to complete it. What are the deadlines? We take stock. Summary…

2022 income tax: can I deduct my dual residence expenses?

INCOME TAX 2022. Do you live in a different place from your main place of residence because of your job? You therefore incur so-called dual residence expenses, deductible on your…