(Tiper Stock Exchange) – Swiss Re closes 2022 with a profit of 472 million dollars, a sharp decrease compared to 1.4 billion dollars in 2021.

The BoD will propose to the April assembly a dividend of $6.4 per share.

It was “a challenging year, characterized by the war in Ukraine, soaring inflation, the tail end of the Covid-19 pandemic and high losses due to natural disasters”, explained the CEO Christian Mumenthaler.

Outlook

For 2023, group targets net income of more than $3 billion, thanks to successful property and casualty reinsurance renewals, expected decline in covid-19 claims, rising interest rates and cost discipline .

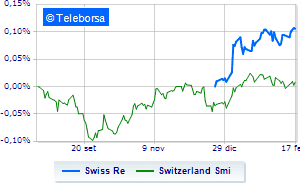

The title Swiss Re it moved little on the Swiss market and traded with a moderate -0.1%.

By comparing the performance of the stock with theSwiss Market indexon a weekly basis, it is noted that Swiss Re maintains positive relative strength compared to the index, demonstrating greater appreciation by investors compared to the index itself (weekly performance +1.05%, compared to +0.43% of the main Swiss stock index).

At present the scenario short of Swiss Re shows a decisive climb with a target identified at 96.12 CHF. In the event of a temporary physiological correction, the most immediate target is seen at 95.37. However, expectations are for a rise in the curve to the top 96.87.