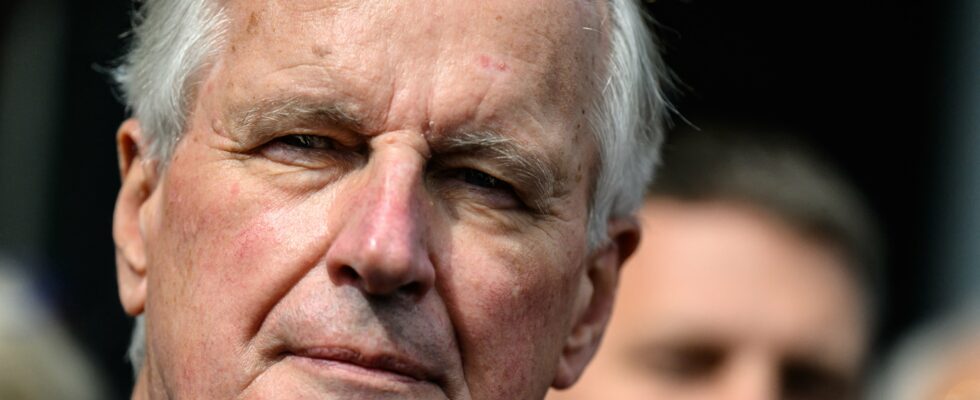

As the presentation of the 2025 budget to Parliament approaches, Michel Barnier reveals his cards to try to absorb a public deficit that has become out of control and which should exceed, at the last count, 6% of GDP this year. The low water level is reminiscent of those of 2009 (7.4%) and 2021 (6.6%).

Two years of acute crises, financial for the first, health for the second, during which France chose to massively increase its public spending to avoid recession. In 2024, neither subprimes nor Covid to justify the drift in national accounts. So what? In an interview on September 27 at Journal of Saône-et-Loire, the Prime Minister sketched the beginning of an explanation: “I found a very degraded situation, much more degraded than has been said.” Having left to teach in Lausanne after a seven-year term at Bercy, Bruno Le Maire must have appreciated the postcard…

The exceptional that lasts, a French tradition

Pushing his right of inventory, the head of government is, at the same time, beginning a turn to the left and recommends reversing certain tax cuts implemented since 2017 by Emmanuel Macron and his troops. “We are going to appeal, in an exceptional and temporary manner, to those who can contribute to this effort,” he breathes. His target? Large companies with a turnover of more than 1 billion euros. By imposing a corporate tax surcharge on them, which would increase from 25% to 33%, 8 billion euros in additional tax revenue could fall into the state coffers. From “temporary”, wooden cross, iron cross…

“Exceptional taxes have existed in France for a long time and they last,” recalled with mischief the public finance expert François Ecalle, in a post published last year on the Fipeco website. Examples abound. In 2012, an exceptional contribution on high incomes, at rates of 3 and 4%, was introduced “until the year in which the public deficit is zero”. It is still in place.

As for the contribution to the repayment of the social debt, created in 1996, it was to stop with the extinction of the said debt, scheduled after thirteen years and one month. A horizon so precise… that it never stops being pushed back. In tax matters, the slogan of May 68 gives rise to a variant well known to specialists: “Exceptions, traps…”