(Finance) – Milan is weak, in the wake of the other Eurozone stock exchanges, in tension after the fiery weekend in Israel. In the meantime, the US markets are moving into negative territoryS&P-500which recorded a decline of 0.22%, awaiting important data from the Fed, arriving this week: inflation in the United States.

On the currency market, theEuro / US Dollar the session continues just below parity, with a drop of 0.42%. Plus sign forgold, which shows an increase of 1.15%. Day of strong gains for oil (Light Sweet Crude Oil), up 4.07%, which could push inflation back up and push the American central bank into new tightening.

It goes up spreadsettling at +205 basis points, with an increase of 5 basis points, with the yield on the 10-year BTP equal to 4.82%.

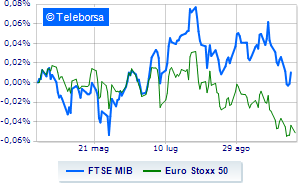

In the European stock market scenario moderate contraction for Frankfurtwhich suffers a decline of 0.67%, flat Londonwhich holds parity, and subdued Paris which shows a filing of 0.55%. Caution prevails in Piazza Affari, with the FTSE MIB which continues the session with a slight drop of 0.46%; along the same lines, slightly decreasing FTSE Italia All-Sharewhich continues the day below par at 29,494 points.

Between best Italian shares large capitalization, buy with both hands on Leonardowhich boasts an increase of 4.79%.

Effervescent Tenariswith an increase of 3.93%.

Definitely positive balance sheet for ENIwhich boasts an increase of 2.27%.

Good performance for Saipemwhich grows by 1.80%.

The strongest sales, however, occur at MPS Bankwhich continues trading at -6.25%.

Negative session for BPERwhich drops by 4.67%.

Significant losses for Amplifondown 4.07%.

Breathless Ivecowhich fell by 4.05%.

Between best stocks in the FTSE MidCap, Acea (+3.05%), Italmobiliare (+2.39%), Caltagirone SpA (+0.53%) e Ascopiave (+0.51%).

The strongest sales, however, occur at Juventuswhich continues trading at -8.50%.

Thud of Secowhich shows a fall of 6.80%.

Letter about Pharmanutrawhich recorded a significant drop of 4.32%.

Goes down Intercoswith a decline of 4.24%.