(Tiper Stock Exchange) – Negative session for the European stock exchanges, which lost further ground after Wall Street’s jarring opening. Of concern is the fact that the US core personal consumption expenditure (PCE) index rose more than expected in January, strengthening the fears that the Fed could continue its rate hikes with a higher end point compared to market expectations a few weeks ago.

“Investors stay revising forecasts on the path of central bank policy in the wake of recent positive economic data – notes Mark Dowding, CIO of BlueBay – indeed it seems that this shift in sentiment has started to have a greater impact on the valuation of risk assets, with equities lower and credit spreads wider “.

The day was rather lacking in macroeconomic indications on the European front. The only news is that in Germany, the decline in GDP in the 4th quarter of 2022 has been revised downwards by two tenths, to -0.4% q/q (+0.9% y/y, with 2022 average growth of +1.9%), with the correction suggesting that the economy has lost further boost at the end of the quarter.

Closes positively Telecom Italywith the BoD “very much appreciating the interest expressed” by kkr extension for the network, but claimed that the non-binding offer “does not fully reflect the value of the asset and TIM’s expectations”.

The heavy discounts Of Sogefiafter the company announced that it will not distribute a dividend, and of doValueafter 2022 results that the market judged below expectations.

Caution prevails overEuro / US Dollar, which continues the session with a slight drop of 0.47%. Caution prevails overgold, which continues the session with a slight drop of 0.58%. The Petrolium (Light Sweet Crude Oil) shows a fractional gain of 0.83%.

Unchanged it spreadswhich stands at +183 basis points, with the yield of 10-year BTP which stands at 4.33%.

Among the main European Stock Exchanges letter about Frankfurtwhich records a significant drop of 1.72%, thoughtfully Londona fractional decline of 0.26%, and falls Pariswith a drop of 1.78%.

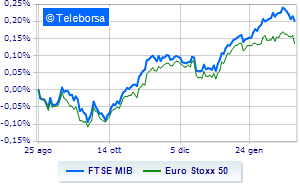

TO Business SquareThe FTSEMIB is down (-1.07%) and stands at 26,986 points at the end, while, on the contrary, a slight increase for the FTSE Italia All-Share, which rises to 29,520 points. Slightly down the FTSE Italia Mid Cap (-0.37%); on the same trend, down the FTSE Italy Star (-1.21%).

On the Milan Stock Exchange it appears that the exchange value in today’s session it amounted to 3.01 billion euro, from 2.94 billion in the previous session; while the volumes traded today went from 0.83 billion shares in the previous session to today’s 0.71 billion.

At the top of the ranking of the most important titles of Milan, we find Saipem (+1.95%), ERG (+1.71%) and Telecom Italy (+1.36%).

The strongest sales, however, fell on Pirelli, which finished trading at -3.76%. Under pressure Interpump, which shows a drop of 3.59%. Slide Iveco, with a clear disadvantage of 2.56%. In red DiaSorinwhich shows a marked decrease of 2.37%.

At the top of the mid-cap rankings from Milan, Danieli (+3.05%), Carel Industries (+2.84%), Intercos (+2.29%) and Datalogic (+1.76%).

The strongest declines, however, occurred on doValue, which closed the session at -7.90%. The negative performance of Salcef Groupwhich drops by 2.47%. wiit drops by 2.34%. Decided decline for Italmobiliarewhich marks a -2.26%.