(Tiper Stock Exchange) – The values for Piazza Affari are weakas well as those of the other European markets, which close the week with realizations and valuations monetary policy prospects. “Rates need to get tight enough and we will keep rates elevated until we see strong evidence that underlying inflation returns to our target,” he said Isabel Schnabel, member of the executive board of the European Central Bank (ECB), in a Q&A on Twitter. Yesterday the president of the Bundesbank, Joachim Nagelsaid the ECB must act decisively to prevent inflation expectations from rising well above the 2% target.

Ivecoafter results and guidance above expectations, is jumped to the highest for about a yearwith CEO Gerrit Marx saying he was optimistic that “we have another solid year ahead, similar to 2022.”

THE securities of the energy sector are supported byincrease in the price of crude oilafter Russia announced it would cut crude oil production by 500,000 bpd in March.

Between banksit sinks unlimited after communicating disappointing and suffering 2023 guidance Bank Systemwhich reported a declining 2022 net profit and announced its intention to list its subsidiary Kruso Kapital.

On the front of the new prices, ha debuted today EuroGroup Laminations, a world leader in the design and manufacture of stators and rotors for electric motors and generators. It is about the Pfirst admission since the beginning of the year to Euronext Milan and the second major IPO in Europe in 2023.

Caution prevails overEuro / US Dollar, which continues the session with a slight drop of 0.60%. L’Gold it is essentially stable at 1,859.4 dollars an ounce. Shopping rain on petrolium (Light Sweet Crude Oil), which shows a gain of 2.03%.

Small step to the top of the spreadswhich reaches +175 basis points, showing an increase of 2 basis points, with the yield of the 10-year BTP equal to 4.08%.

Among the main European Stock Exchanges in red Frankfurtwhich shows a marked decrease of 1.39%, moves below parity Londonshowing a decrease of 0.45%, and the negative performance of Pariswhich drops by 0.82%.

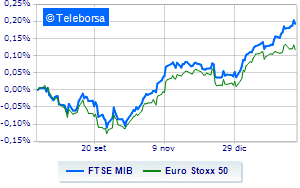

TO Business SquareThe FTSEMIB it is down (-0.86%) and stands at 27,268 points at the end, breaking the positive chain of four consecutive increases, which began last Monday; along the same lines, bad day for the FTSE Italia All-Share, which closes the session at 29,477 points, down by 0.95%. Bad the FTSE Italia Mid Cap (-1.89%); along the same lines, in sharp decline the FTSE Italy Star (-1.76%).

From the closing data of Milan, the exchange value in today’s session it appears to have been equal to 2.5 billion euros, down (-11.05%) compared to the previous 2.81 billion; while the volumes traded went from 1.03 billion shares in the previous session to today’s 0.69 billion.

Among the best Blue Chips of Piazza Affari, exploit of Iveco, which shows an increase of 15.99%. Money up ENI, which recorded an increase of 2.83%. Very positive balance for Tenaris, which boasts an increase of 1.69%. Composed Is in thewhich grows by a modest +1.33%.

The worst performances, however, were recorded on Phinecus, which closed at -4.47%. Bad performance for amplifierwhich records a drop of 3.97%. Nexi drops by 3.85%.

Decided decline for Azimuthwhich marks a -3.4%.

At the top of the mid-cap rankings from Milan, Luve (+5.45%), Saras (+2.20%), Bff Bank (+1.91%) and Banca Ifis (+1.70%).

The strongest declines, however, occurred on Illimity Bank, which closed the session at -8.06%. Black session for GV extension, which leaves a loss of 5.85% on the table. At a loss MPS Bank, which drops by 5.38%. Under pressure ENAVwith a sharp drop of 4.34%.