(Finance) – Effervescent Stellantiswhich trades with a decidedly positive performance of 3.19%.

The Group closed the first half with a Net income of 8 billion euros (+ 34% year on year) e revenues equal to 88 billion (+ 17%). The available industrial liquidity is equal to 59.7 billion euros.

“In a complex global context, we continue on the path of the ‘Give Forward’ plan, achieving extraordinary performances and implementing our ambitious electrification strategy. Together with the resilience, agility and entrepreneurial mindset of our people and thanks also to our partners innovative, we are transforming Stellantis into a sustainable and future-ready mobility technology company “- says CEO Carlos Tavares -. “I would like to express my sincere appreciation to all Stellantis employees for their commitment and contribution to these results.”

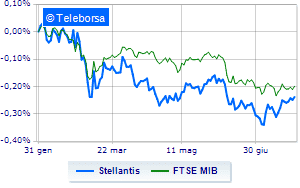

The stock analysis performed on a weekly basis highlights the uptrendline of the Italian-French-American car manufacturer more pronounced than the trend of FTSE MIB. This expresses the greater attractiveness towards the title by the market.

The short-term technical status of Stellantis highlights an expansion of the positive performance of the curve with the first area of resistance identified at Euro 13.49. Risk of possible correction up to target 13.2. Expectations are for an increase in the uptrendline towards the 13.77 resistance area.