(Tiper Stock Exchange) – Wall Street is moving cautiouslywith investors waiting for the Fed’s moves and indications. After the still restrictive attitude shown yesterday by some central banks, in particular those of Canada and Australia, the Investors fear that even the Federal Reserve could resume raising rates after the break of June, keeping them at high levels for a long time. Yesterday, the Bank of Canada raised rates by 25 basis points, to 4.75%, the highest since 2001, interrupting a 4-month pause that began in January to assess the effects of the restriction implemented in the previous 10 months.

On the macroeconomic front, the new claims for unemployment benefits in the US in the week ending June 3; the “claims” amounted to 261 thousand units, an increase of 28,000 units compared to the figure of the previous week, and above the 235 thousand of the consensus. Investors also find themselves valuing inventories and wholesaler sales, as well as gas inventories.

Between titles under observation there is GameStopafter billionaire investor Ryan Cohen took over as executive chairman following the CEO’s firing and a bigger-than-expected loss. Signet Jewelers reported declining quarterly sales and earnings, Carvana improved outlook for Q2 2023 e Adobe has announced that it will offer Firefly to large companies to create content with AI.

Eyes on too Meta Platformsafter the European Commissioner for Internal Market and Services Thierry Breton he said he will meet with the CEO Mark Zuckerberg on June 23 and will ask him to take immediate action to tackle the problem of child pornography content online.

As for i stocks affected by analysts’ ratingsWells Fargo has started coverage on Amazon with an Overweight, Jefferies cut the judgment up Las Vegas Sands to Hold, Wolfe Research improved the recommendation on T-Mobile to Outperform.

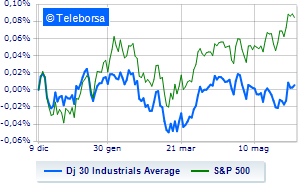

As for i main indicesThe Dow Jones it is substantially stable and stands at 33,709 points; on the same line, stay flat theS&P-500, with the quotations standing at 4,272 points. Slightly positive the NASDAQ 100 (+0.33%); with analogous direction, in fractional progress theS&P 100 (+0.22%).