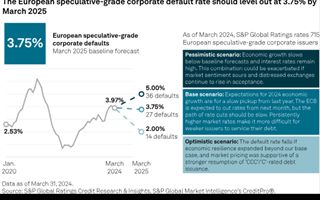

(Finance) – We expect a 12-month default rate for European corporate issuers speculative grade equal to 3.75% by March 2025, only slightly lower than the default rate of 4.1% over the 12 months ending in April 2024. This is what emerges from the report “The European speculative-level default rate is expected to stabilize at 3.75% by March 2025”.

But our basic predictions they also see an acceleration in economic growth in the euro area and the United Kingdom in 2024-2025, with consumer price inflation in the euro area slowing in the near term.

“This should help lower-rated issuers because 28% of issuers rated at or below the ‘CCC’ category operate in consumer-facing sectors, such as consumer products, media and entertainment,” he says Nick W. Kraemer of S&P Global Ratings Credit Research and Insights.

From the report, one emerges optimistic scenario, where the default rate drops to 2% by March 2025 in a more resilient than expected European economy and one pessimistic scenario which foresees a default rate of 5%, partly due to slower-than-expected economic growth in Europe, which would further strain corporate cash flows.