In 2022, the global smartphone image sensor market will account for approximately annual smartphone shipments. 11% drop and multiple cameras will face a decline as its adoption trend slows down. This has resulted in a contraction in CIS (CMOS image sensor) sales, and in particular 8MP and Dlow megapixel sensor This led to the correction of the overstock.

Global smartphone image sensor shipments compared to 2021, according to Counterpoint’s Smartphone Camera reports decreased by 15% and all major suppliers are seeing decreases to varying degrees. However, there are a few vendors who have managed to stand out in this regard.

Sony was the only major seller to report year-over-year revenue growth thanks to Apple’s camera upgrades. Contributing to an estimated half of Sony Mobile’s CIS revenue applethroughout the year iPhone further improved the camera features.

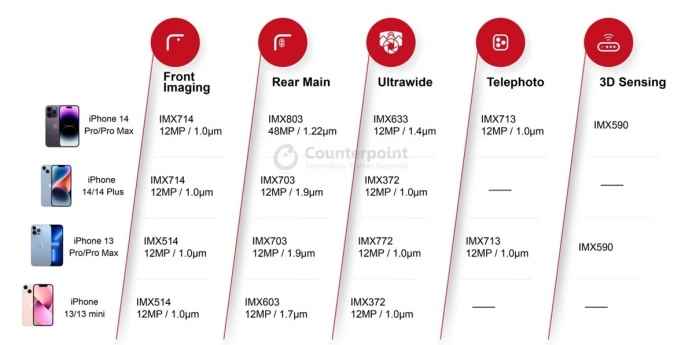

iPhone 14 Pro and Pro Max introduce a new A for main rear camera 48MP image sensorIt comes with a larger ultra-wide sensor and a front-facing sensor with autofocus. As a result of these upgrades, Sony 2022In the second half of each unit More than $6 or approximately $300 million in sales guessing it added.

On the Android side, Samsung LSI has also taken advantage of the trend of camera improvements and product mix, partially offsetting the sharp drop in shipments. Samsungwith an expected shipment of 200 million units in 2022 High resolution below 0.7μm has the first mover advantage in mass production sensors.