(Finance) – Somec communicated that starting from 9 May 2022 it will come launch of a new program for the purchase of treasury shares on the basis of the authorization resolution approved by the Shareholders’ Meeting of 29 April 2022.

The program aims to provide the Company with a flexible and functional tool to pursue some of the purposes compatible with the current legal and regulatory provisions and in particular:

- have own shares to be allocated to service the long-term variable incentive plan, of the type called “2021-2025 Long-Term Variable Incentive Plan” reserved for some of the Group’s strategic resources, approved by the Shareholders’ Meeting of 29 April 2021 ;

- have a “securities warehouse” to be used, in line with the Company’s strategic guidelines, to service any extraordinary transactions and / or the possible use of shares as consideration in extraordinary transactions, including the exchange of shareholdings with other subjects in the of operations of interest to the Company.

The purchases will be made in the manner and within the terms established by the aforementioned shareholders’ resolution for a maximum quantity of 11,500 shares ordinary shares with no indication of the nominal value of the Company, (representing 0.17% of the current share capital), by 30 June 2022. The potential maximum outlay of purchase related to the execution of the program is estimated at approx 400,000 euros.

The Company has given a mandate to Intermonte SIM to coordinate and execute the purchase program and take the negotiation decisions relating to the program with discretion and in full independence.

As of May 6, Somec owns 22,366 treasury shares, equal to 0.32% of the share capital. The subsidiaries do not hold Somec shares.

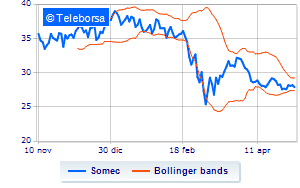

In Piazza Affari, today, sitting down for the Company specialized in the engineering, design and implementation of complex turnkey projects in civil and naval engineeringwhich brings home a decrease of 1.06%.