(Tiper Stock Exchange) – Wall Street is little moved, after the declines of recent dayswhile worries about a global recession are growing. Adding to the fears were trade data from China, which showed exports and imports both contracted at steeper rates in November, indicating sluggish demand. “THE recent economic data have highlighted the uncertainty about the economic outlook and the response of the FED – wrote Mark Haefele, chief investment officer of UBS Global Wealth Management in a note – We expect further volatility and maintain our defensive exposure”.

Also, investors are eyeing new US inflation data and FED decisions next week. Strength in jobs and services in the United States is putting pressure on Powell and on other US central bank policymakers to continue their aggressive campaign to tame inflation, rather than lean towards more modest interest rate hikes.

On the macroeconomic front, rates continued to decline mortgage applications in the United States, while rates on 30-year mortgages fell further, settling at 6.41% from 6.49% the previous week. In the 3rd quarter, the productivity of the non-farm sector in the US increased by 0.8%, beating expectations and the preliminary estimate, while the cost per unit of work increased by 2.4%, lower than the preliminary figure. They have decreased more than expected crude stocks in the last week.

Campbell Soupa historic US canning company famous for its soups, has increased its guidanceafter successfully mitigating significant inflationary pressure.

Lowe’sa US home improvement retailer, confirmed its financial outlook for the full year 2022 and authorized a new buyback program of common stock worth $15 billion.

Pinteresta social media platform based on the sharing of photographs, videos and images, has entered into an agreement with Elliott Investment Management, which provides for the appointment of Marc Steinberg, Elliott’s Senior Portfolio Manager, to the board of directors.

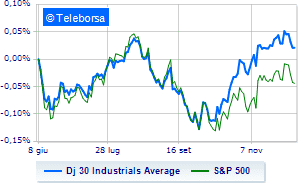

Sitting little move for Wall Street, with the Dow Jones which advances to 33,669 points (+0.22%), while, on the contrary, theS&P-500, with the quotations standing at 3,942 points (+0.1%). Slightly negative the NASDAQ 100 (-0.21%); on parity theS&P 100 (-0.06%).

Among the best Blue Chips of the Dow Jones, Home Depot (+1.36%), 3M (+1.18%), Merck (+0.85%) and Walgreens Boots Alliance, (+0.74%).

The strongest sales, on the other hand, show up Salesforce,, which continues trading at -1.70%. Modest descent for Apple, which drops a small -1.43%. Thoughtful Visa, a fractional decline of 0.92%. He hesitates intelwith a modest decline of 0.91%.

On the podium of the Nasdaq stocks, PayPal (+2.80%), Regeneron Pharmaceuticals (+2.42%), Applied materials (+2.31%) and Constellation Energy (+2.18%).

The strongest sales, on the other hand, show up Booking Holdings, which continues trading at -4.10%. They focus their sales on AirBnb, which suffers a drop of 3.31%. Sales on Tesla Motors, which records a drop of 3.10%. Bad sitting for JD.comwhich shows a loss of 2.42%.

Among the data relevant macroeconomics on US markets:

Wednesday 07/12/2022

2.30pm USA: Unit Labor Cost, Quarterly (Expected 3.1%; Previous 3.5%)

2.30pm USA: Productivity, Quarterly (Expected 0.6%; Previous 0.3%)

4.30pm USA: Oil inventories, weekly (exp -3.31 Mln barrels; prev -12.58 Mln barrels)

Thursday 08/12/2022

2.30pm USA: Initial Jobless Claims, Weekly (Expected 230K; Previously 225K)

Friday 09/12/2022

2.30pm USA: Production prices, annual (expected 7.2%; previous 8%).