(Finance) – Milan is weak along with the other Eurozone stock exchangesin a week dominated by the wait for the Fed’s Beige Book and some macro data of a certain importance arriving from the USA and China.

L’Euro / US Dollar the session continues at the levels of the day before, reporting a change of -0.02%. No significant changes forgold, which trades on the day before at $2,015.8 per ounce. Positive session for oil (Light Sweet Crude Oil), showing a gain of 1.25%.

Small step upwards of spreadwhich reaches +176 basis points, showing an increase of 2 basis points, with the yield on the 10-year BTP equal to 4.31%.

Among the main European stock exchanges substantially unchanged Frankfurtwhich reports a moderate -0.11%, substantially weak Londonwhich recorded a decline of 0.42%, and moved below parity Parishighlighting a decrease of 0.46%.

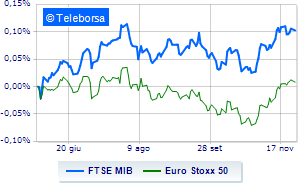

Piazza Affari moves fractionally lower, with the FTSE MIB which is leaving 0.28% on the floor; along the same lines, sells the FTSE Italia All-Share, which relegates to 31,197 points. Under parity the FTSE Italia Mid Cap, which shows a decline of 0.61%; with similar direction, negative variations for the FTSE Italia Star (-0.91%).

Between best performers of Milan, highlighted Iveco (+1.25%), ERG (+1.01%), BPM desk (+0.83%) e CNH Industrial (+0.76%).

Among the strongest declines is noteworthy DiaSorinwhich continues the session with -3.47%.

Sales up Monclerwhich recorded a decline of 2.38%.

Negative session for Campariwhich shows a loss of 1.87%.

Under pressure Amplifonwhich suffered a decline of 1.64%.

At the top among Italian shares a mid-cap, Ascopiave (+1.34%), Technoprobe (+1.29%), Antares Vision (+1.01%) e Brembo (+0.85%).

The strongest sales, however, occur at Sesawhich continues trading at -3.15%.

It slides El.Enwith a clear disadvantage of 2.71%.

In red Brunello Cucinelliwhich highlights a sharp decline of 2.66%.

The negative performance of Replywhich fell by 2.19%.