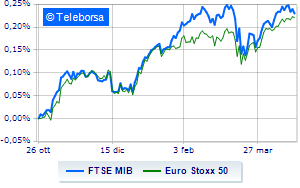

(Tiper Stock Exchange) – Milan is weakin the wake of the other exchanges of Euroland.

Caution prevails overEuro / US Dollar, which continues the session with a slight drop of 0.30%. Basically stable thegold, which continues the session on the previous day’s levels at 1,991.4 dollars an ounce. Negative day for oil (Light Sweet Crude Oil), which continues trading at 77.65 dollars per barrel, down 1.41%.

On equality it spreadswhich remains at +186 basis points, with the yield on the ten-year BTP standing at 4.31%.

Among the markets of the Old Continent colorless Frankfurtwhich does not record significant changes, compared to the previous session, without momentum Londontrading at -0.17%, and subdued Paris showing a filing of 0.69%.

Negative session for Piazza Affari, with the FTSEMIB which is leaving 0.99% on the floor; along the same lines, sales spread on the FTSE Italia All-Sharewhich continues the day at 29,431 points.

Below parity the FTSE Italia Mid Cap, which shows a decline of 0.45%; along the same lines, negative changes for the FTSE Italy Star (-0.78%).

Inwitwhich scores +0.81%, is theunique among the Blue Chips of Piazza Affari to report an appreciable performance.

The strongest sales, on the other hand, show up DiaSorinwhich continues trading at -2.50%.

Iveco drops by 2.39%.

Decided decline for Telecom Italywhich marks a -2.11%.

Under pressure Leonardowith a sharp drop of 1.89%.

At the top of the mid-cap rankings from Milan, Bff Bank (+1.21%), Tod’s (+1.20%), OVS extension (+1.19%) and MARR (+0.72%).

The worst performances, however, are recorded on Juventuswhich gets -6.49%.

He suffers MFE Bwhich shows a loss of 2.74%.

Prey of sellers Carel Industrieswith a decrease of 2.57%.

They focus their sales on Drywhich suffers a drop of 2.40%.

Among the data relevant macroeconomics:

Tuesday 04/25/2023

3pm USA: FHFA House Price Index, Monthly (Expected -0.1%; Previous 0.1%)

3pm USA: S&P Case-Shiller, annual (exp. 0.1%; previously 2.6%)

4:00 pm USA: New home sales, monthly (exp. 1.1%; previous 1.1%)

4:00 pm USA: Sale of new houses (expected 630K units; previous 640K units)

4:00 pm USA: Consumer confidence, monthly (expected 104 points; previous 104.2 points).