Bonds regain their appeal! These listed debt securities, issued by governments, financial institutions or companies, had lost much of their appeal in recent years due to the extremely low interest rates. But the sudden rise in the latter has made it possible to rediscover this category of investments which provides regular remuneration. In fact, each issuer must, depending on the duration of its loan and its intrinsic quality, pay interest to its lenders. These reached very satisfactory levels last year: the return offered by a good quality company was close to 4% while companies considered risky posted more than 7% on average.

NEW3789CT Five bond funds to hold in 2024

© / The Express

“The period when there was no solution outside of equities is over,” assures Sophie Monnier, asset allocation and diversified investment product specialist at Oddo BHF AM. From now on, bond investors are remunerated for the risk taken. In fact, in some of our diversified funds, we have doubled our position in bonds.” This year, however, we must deal with a changing environment since the economic slowdown and the end of monetary tightening by central banks will affect the bond market. Here are six strategies that should stand out.

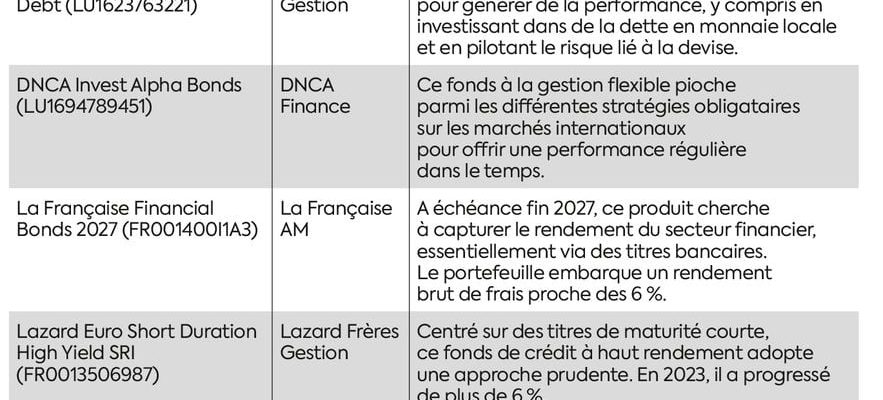

1. High-yield credit: an interesting carry, provided you are selective

To issue debt on the financial markets, most entities must pass through the caudal forks of the rating agencies. These assess the quality of the issuer, that is to say its ability to pay its interest and repay its loan on time. An analysis sanctioned by a rating: the worse it is, the higher the entity must offer a high interest rate to attract lenders and vice versa. The best ratings are grouped into the category investment grade and the worst in the “high yield” category or high yield. “The surplus remuneration offered by the high yield still seems interesting to us at the moment, believes Guillaume Truttmann, listed credit manager at Eiffel IG. Its return is higher than inflation and the rate of good funds in euros, even once the costs of the product and those of life insurance are deducted. We can in fact obtain a net gain of 5.5 to 6%.”

This category will, however, have to face an increase in the default rate in 2024 (when the company can no longer pay what it owes), expected to be around 3%. “We are simply returning to normal,” said François Rimeu, senior strategist at La Française AM. “And that’s quite healthy because some zombie companies that are too indebted will disappear.” Enough to distinguish robust activities from others.

2. Emerging debt: a good return/risk ratio

Despite the massive debt of States, the remuneration offered by them to finance themselves is limited. For example, the ten-year German Bund yields less than 3%! A notable exception concerns emerging debt. Traditionally riskier than that from developed countries, it is accompanied by attractive rates. “Over the last decade, emerging countries have shown themselves to be virtuous in their monetary and budgetary policies,” underlines François Collet, deputy director of management at DNCA Finance. Their debt to GDP (gross domestic product) ratio is lower than that of developed countries.” A solidity that does not prevent high yields. The manager therefore favors countries in Eastern Europe and Latin America. “Romania, rated BBB by the rating agencies, issues five-year securities which pay more than 5%, he illustrates. This is better than any quality European company Investment grade !”

3. Target date funds: simple and readable

Without a doubt, 2024 should still remain favorable for target-date bond funds. The latter have an end date known in advance and have the advantage of behaving more or less like an obligation. “They pay a coupon equal to the average of the coupons of all the bonds in the portfolio and are reimbursed at maturity,” indicates Guillaume Truttmann. Be careful, however, to carefully check the investment universe and the constraints set for the manager. The latter may in fact be tempted to select securities longer than the maturity of the fund to seek additional performance, at the cost of taking greater risk. Also keep in mind this other rule: the closer the maturity date, the more the fund’s risk is reduced. Indeed, unlike conventional vehicles, “the residual life of the securities in the portfolio decreases over time”, underlines Guillaume Truttmann.

4. Flexible bond funds: to ride the trends

Less popular recently, flexible bond funds could return to the forefront because they have a serious advantage: they can juggle from one strategy to another depending on opportunities. “A cut in central bank rates is expected in 2024, but it may not be as strong as expected, which could create movements on the market,” points out François Collet. Such a volatile environment is conducive to flexible offers because they can take advantage of interest rate movements.” Then target products with the greatest possible scope of action.

5. Financial bonds: additional yield at a low cost

Banks currently pay an additional remuneration of around 2 percentage points compared to issuers of equivalent non-bank quality. “Issuance was abundant throughout 2023 and demand was a little less significant due to the rise in rates,” explains David Benamou, managing partner and director of investments at Axiom Alternative Investments. “Investors have favored other supports such as money market funds. This imbalance between supply and demand allows a gross return of around 7% onInvestment grade.” Another factor justifying this gap: the crisis experienced by the sector in February-March 2023 and the distrust of investors since the great financial crisis of 2008. However, “the prudential rules in the euro zone are very strict and the sector is very healthy “, assures François Rimeu, of La Française AM. But it obviously takes time to modify investors’ representations…

6 Inflation-indexed bonds: protecting yourself against a blowback

This is a long-term bet! These securities have the particularity of offering a coupon whose value is not fixed since it depends on the level of inflation. At present, while the phenomenon of rising prices seems to be coming to an end, they are trading cheaply. However, “inflationary risks have not completely disappeared, recalls François Collet. There remain structural factors which will support inflation in the coming years at a higher level than in the past. In this context, indexed bonds are interesting because they offer positive remuneration once inflation is deducted.” A protection that can be useful to hold in your portfolio.

An article from the L’Express special report “Investing in 2024: the right strategies for an uncertain environment”, published in the weekly on February 15.

.