(Finance) – Purchases on the Milan Stock Exchange prevail, in pole position compared to a positive Europe, thanks to the excellent performance of the banks. There is speculation on banking risk (Il Foglio reported that a large investment bank is preparing a feasibility study relating to an operation that would see the acquisition of Mediobanca by UniCredit through a public exchange offer in a 12 billion euro operation, which would eventually also involve Generali), the opinions of the analysts (BofA has improved its recommendation on Banco BPM to Buy from Hold, with a target price of 7 euros from the previous 5.5 euros, inserting the title in its Europe list 1) and the next revision of the basket (Banca Popolare di Sondrio could enter the FTSE MIB in place of Banca Generali).

On the currency market, theEuro / US Dollar it is essentially stable and stops at 1.083. Slightly rising seat for thegold, which advances to 2,038.3 dollars an ounce. A day to forget for oil (Light Sweet Crude Oil), which trades at 77.04 dollars per barrel, with a drop of 2.00%.

Consolidates the levels of the day before spreadsettling at +148 basis points, with the yield on the 10-year BTP standing at 3.82%.

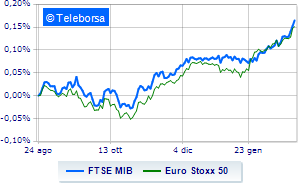

Among the Euroland indices modest performance for Frankfurtshowing a moderate rise of 0.28%, resistant Londonwhich marks a small increase of 0.28%, and Paris advances by 0.70%. Positive session for the Milanese stock exchange, which brought home a gain of 1.07% on the FTSE MIB, consolidating the series of four consecutive increases that began last Tuesday; along the same lines, the FTSE Italia All-Share it gains 1.00% compared to the previous session, closing at 34,838 points.

In Piazza Affari the exchange value in the last session it was equal to 3.05 billion euros, down by 9.46%, compared to 3.37 billion the day before; as regards volumes, these stood at 0.62 billion shares, compared to the previous 0.72 billion.

Between best performers of Milan, highlighted BPM desk (+5.40%), Mediobanca (+5.24%), Generali Insurance (+3.26%) e Generali Bank (+2.73%).

The steepest declines, however, occurred on Campariwhich ended the session at -2.01%.

Sales up STMicroelectronicswhich recorded a decline of 1.68%.

Basically weak Finecowhich recorded a decline of 0.83%.

It moves below parity Snamhighlighting a decrease of 0.73%.

Among the protagonists of the FTSE MidCap, Philogen (+4.30%), Juventus (+3.89%), Seco (+3.65%) e Banca Popolare di Sondrio (+3.61%).

The worst performances, however, were recorded on LU-VE Groupwhich closed at -2.09%.

Negative session for Ariston Holdingwhich shows a loss of 1.91%.

Under pressure Maire Tecnimontwhich suffered a decline of 1.85%.

Moderate contraction for Ferragamowhich suffers a decline of 1.49%.