(Finance) – Wall Street aligns with the positive day of the European markets and shows a generalized rise, while investors always find themselves evaluating the trend of inflation, the choices of central banks and the effects that the latter can have on growth. It is not in fact excluded the entry into recession from various advanced and emerging countries.

“Global growth has slowed significantly while strong downside risks persist. Growth has desynchronized between regions and fragmentation is being created between sectors and countries – commented Patrice Gautry, Chief Economist of Union Bancaire Privée (UBP) – In developed countries growth could deteriorate sharply in the 4th quarter and the cycle could be interrupted, with a technical recession on the quarterly data and a prolonged period of contained growth; with growth forecast at 1% or less, a change in economic policy should lead on average to lower inflation and higher unemployment. “

On macroeconomic frontapplications for subsidies to the unemployment in the US in the past week, US layoffs rose in June and fell on trade deficit American in May.

Among the titles under comments there are GameStop (after the board has approved a stock split four for one which will make it easier for investors to own shares), Seagen (The Wall Street Journal reported that colossus Merck & Co is in advanced negotiations to buy it for about 40 billion dollars), Virgin Galactic (announced a deal with a subsidiary of Boeing for build aircraft supporting its future spacecraft fleet).

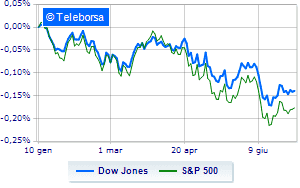

Earnings Day for the New York Stock Exchangewith the Dow Jones, which shows a capital gain of 0.78%; on the same line, rising theS & P-500, which increases compared to the day before reaching 3,881 points. Positive the Nasdaq 100 (+ 0.98%); on the same line, in money theS&P 100 (+ 0.85%). Noticeable upside in the S&P 500 for i compartments power (+ 3.69%), materials (+ 1.71%) e financial (+ 1.46%).

At the top of the ranking of American giants components of the Dow Jones, Caterpillar (+ 3.95%), Boeing (+ 3.00%), Intel (+ 2.62%) e Chevron (+ 2.60%).

The worst performances, on the other hand, are recorded on 3Mwhich gets -0.52%.

On the podium of the Nasdaq titles, Lam Research (+ 4.75%), Marvell Technology (+ 4.50%), Qualcomm (+ 4.49%) e Applied Materials (+ 4.24%).

The worst performances, on the other hand, are recorded on NetEasewhich gets -2.23%.

Undertone Vertex Pharmaceuticals which shows a filing of 0.82%.

Disappointing Cognizant Technology Solutionswhich lies just below the levels of the eve.

Lazy Paychexwhich shows a small decrease of 0.68%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Thursday 07/07/2022

13:30 USA: Challenger layoffs (formerly 20.71K units)

14:30 USA: Balance of trade (expected -84.9 B $; previously -86.7 B $)

14:30 USA: Unemployment Claims, Weekly (Expected 230K Units; Previous 231K Units)

17:00 USA: Oil stocks, weekly (expected -1.04 Mln barrels; prev. -2.76 Mln barrels)

Friday 08/07/2022

14:30 USA: Unemployment rate (expected 3.6%; previous 3.6%).