(Finance) – Wall Street is gaining ground during the session, pushed by positive quarterly reports from some giantsalthough concerns remain for the escalation of tension between the West and Moscow on the invasion of Ukraine. The performance of the Microsoft (which predicted double-digit revenue growth for the next fiscal year, driven by demand for cloud computing services), while the stock suffers Alphabet (with Google parent company missing revenue expectations as the war in Ukraine hurt YouTube ad sales).

Collapses Boeingwhich registered a broader quarterly loss last year and reported higher costs and delays in the development of some aircraft while flying Mattelwith the Wall Street Journal reporting on theinvolvement of private equity companies for the toy manufacturer, e Visawhich posted a positive quarter, helped by a rebound in consumer spending.

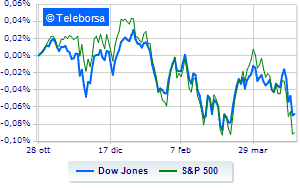

On Wall Street, the Dow Jones continue the day with a increase 1.19%, to 33,634 points; on the same line, rising theS & P-500, which increases compared to the day before reaching 4,232 points. Salt the Nasdaq 100 (+ 1.38%); as well, positive theS&P 100 (+ 1.36%).

Positive result in the S&P 500 basket for i sectors informatics (+ 2.95%), materials (+ 2.45%) e power (+ 1.79%). The sector telecommunicationswith its -1.19%, it is the worst of the market.

Between protagonists of the Dow Jones, Visa (+ 8.40%), Microsoft (+ 6.94%), Salesforce (+ 3.85%) e Nike (+ 2.05%).

The strongest sales, on the other hand, show up on Boeingwhich continues trading at -7.64%.

Under pressure Cisco Systemswhich shows a decrease of 1.61%.

It moves below par Johnson & Johnsonshowing a decrease of 0.67%.

Moderate contraction for Verizon Communicationwhich suffers a drop of 0.57%.

On the podium of the Nasdaq titles, JD.com (+ 7.48%), Pinduoduo Inc Spon Each Rep (+ 7.29%), Microsoft (+ 6.94%) e Baidu (+ 5.71%).

The strongest sales, on the other hand, show up on Netflixwhich continues trading at -3.01%.

Goes down Alphabetwith a decrease of 2.11%.

Collapses Alphabetwith a decrease of 2.01%.

It slips Modernwith a clear disadvantage of 1.95%.

Between macroeconomic quantities most important of the US markets:

Wednesday 27/04/2022

14:30 USA: Wholesale stocks, monthly (formerly 2.5%)

4:00 pm USA: Home sales in progress, monthly (expected -1.6%; previous -4%)

16:30 USA: Oil stocks, weekly (2 million barrels expected; previously -8.02 million barrels)

Thursday 28/04/2022

14:30 USA: Unemployment Claims, Weekly (Expected 180K Units; Previously 184K Units)

14:30 USA: GDP, quarterly (1.1% expected; previously 6.9%).