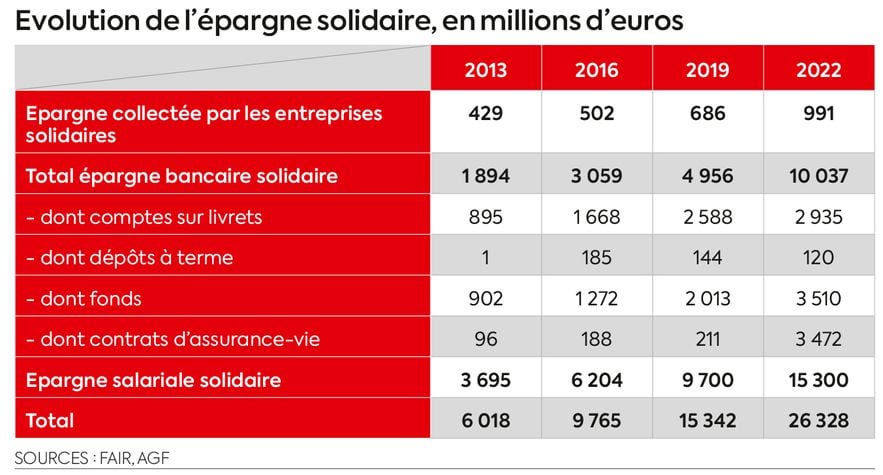

The outstanding solidarity finance amounted to 26.3 billion euros at the end of 2022 according to the FAIR association, a figure up 7.4% over one year. This concept brings together all investments aimed at financial performance but also social or environmental profitability.

In other words, they allow you to invest your money in classic products such as savings accounts, funds or life insurance contracts, but they have a little “extra”: they finance in particular access to housing or the employment of people in difficulty or even ecological activities.

CT3804 finansol investments

© / The Express

Formerly mainly subscribed to by community activists more interested in the social objective than in financial returns, solidarity investments are now widely distributed among savers. The natural gateway to these products is represented by solidarity booklets. These operate like the Livret A, to which is added a system allowing a fraction of the interest received to be donated to an association. A donation which entitles you to an income tax reduction equal to 66% of the amount paid within the limit of 20% of taxable income or 75% within the limit of 1,000 euros for associations helping people in need. difficulty.

The saver therefore gives up part of the return, between 25% and 100%, but he preserves his capital since only the interest is the subject of a donation. Very involved in solidarity finance, Crédit Coopératif notably offers the Agir booklet, half of the interest in which is donated to an organization chosen by the holder from a list of 22 names (French Red Cross, Médecins du Monde, SOS Children’s Villages, WWF…). It earns 1.20% gross per year up to 15,300 euros then 0.20%. “The Agir booklet paid 2.6 million euros to associations in 2023, after 1.4 million euros in 2022,” indicates Imad Tabet, director of the individual market at Crédit cooperative.

The yield on all solidarity savings accounts on the market has risen sharply for eighteen months in a context of an increase in key rates by the European Central Bank. The best on the market yield 3.50% gross, such as the Savings Booklet for others (up to 20,000 euros, then 0.70%) from Crédit Mutuel Alliance Fédérale or the Solidarity Booklet from Crédit Mutuel du Sud- West.

A win-win solution

Crédit Coopératif, Banque Postale, Maif and Société Générale (SG) also offer a sharing option on their regulated savings accounts, covering 25% to 100% of interest. A win-win solution because the Livret A and the Sustainable and Solidarity Development Booklet (LDDS) are today the most profitable risk-free investments on the market (3% exempt from taxes and social security contributions). The Postal Bank and SG add a donation of 10% of the interest paid by their customers. Be careful not to confuse this mechanism with that allowing you to make a donation directly from your LDDS (this involves donating a fraction of your capital, and not the interest).

Some solidarity booklets operate without sharing interests, but with earmarking of the sums collected. This is the case, for example, of the La Nef booklet or the Rev 3 booklet of Crédit coopératif. “This finances loans to structures in the Hauts-de-France region involved in renewable energies, energy efficiency or even the circular economy and mobility,” explains Imad Tabet.

Beyond savings accounts, it is possible to show solidarity with your savings by investing in the longer term via solidarity funds, also called “90-10” because of their mode of operation. They devote 5% to 10% of their outstanding funds to financing the social and solidarity economy (ESS), the balance (90% to 95%) being freely invested in shares, bonds and/or money market funds. These funds are widely distributed as part of employee savings, through company savings plans and collective retirement savings plans – it is even an obligation.

Unlike booklets, there is no donation here, but an investment in the ESS in the form of bonds or equity securities. “The solidarity pocket of 5 to 10% has no impact in terms of performance, but the saver takes a capital risk, both on the 90% and on the 10%, since the investment is made in shares and/or in bonds”, specifies Patrick Sapy, the general director of FAIR.

The market pioneer

A pioneer in the market since it celebrates its 30th anniversary this year, Mirova’s Insertion Emplois Dynamique fund supports ESS structures acting on the theme of job creation through a partnership with France Active, an associative movement supporting entrepreneurs through financing and advice. The theme is also reflected in the selection of the 90% of listed European stocks constituting the balance of the portfolio. The fund was labeled Finansol in 1997, the year this label was created to distinguish solidarity investments. It rewards 190 products as of December 31, 2023.

3804CT evolution solidarity savings

© / The Express

90-10 solidarity funds are also accessible directly, in banks and life insurance contracts, the latter also having the obligation to offer solidarity support among their units of account. There are even some 100% solidarity life insurance contracts, such as Maif Responsible and Solidarity Life Insurance, offering 14 labeled units of account, as well as a solidarity euro fund. A rare product! This invests at least 5% of its assets in ESS entities, or more than 200 million euros out of a total of 3.1 billion euros. It provided a return of 2.5% in 2023, a level comparable to traditional products. “The responsible and inclusive investment strategy, launched in 2009, demonstrates this: it is possible to combine ethics and performance in the long term,” underlines Loïc Dano, savings product manager at Maif.

Some savers wish to go further in their commitment by investing directly in the capital of a social and solidarity economy organization. Some big names in the sector such as Habitat et Humanisme, Emmaüs and Terre de Liens open the capital of their real estate to individuals. The sums collected directly by ESS companies will thus reach 991 million euros at the end of 2022 according to FAIR. The characteristics of this type of investment are specific to each organization. Some pay an annual return and/or regularly revalue the share value. Others, conversely, do not provide any form of remuneration.

Finally, certain structures entitle you to a tax advantage: the saver can deduct 25% of their investment from their income tax up to a payment of 50,000 euros for a single person and 100,000 euros for a couple. You should therefore think about the cause that motivates you, identify the entity you wish to support and check the precise conditions of the investment on its website. The entry ticket is generally limited to a few tens or hundreds of euros. At Villages vivants, for example, the cooperative’s shares do not pay a return, but the saver benefits from a form of indirect remuneration thanks to the tax advantage. The money collected is used to buy premises in rural areas to set up bakeries, grocery stores, cafes, etc.

“There are also crowdfunding platforms specializing in sustainable investment such as LITA.co or MiiMosa, points out Patrick Sapy. This allows individuals to directly support ESS organizations that they would not necessarily have identified elsewhere.” These platforms offer to invest in the form of shares or bonds. Nous Epiceries anti-waste thus offers on LITA.co to subscribe to bonds yielding 10.5% over four years. The network of stores offering products destined to be thrown away is seeking to collect 2.5 million euros to open new grocery stores.

Be careful though. With these arrangements, it is you who bear the risk in the event of default by the financed establishment. It is therefore prudent to ensure the solidity of the projects before investing.

An article from the special report “Responsible Investments”, published in L’Express on May 30.

.