(Tiper Stock Exchange) – Bad day for Wall Streetafter that new macroeconomic data support the aggressive stance of the US central bank and some hawkish comments from Fed officials reiterated that interest rates will stay elevated longer than expected. The FOMC minutes, released last night, had already highlighted the Federal Reserve’s hawkish stance and its commitment to fight inflation through further interest rate hikes.

The chairman of the Atlanta Federal Reserve, Raphael Bosticsaid today that inflation is “the biggest headwind” facing the US economy and US central bank officials”they remain determined” to bring it back to the 2% target. Esther Georgepresident of the Federal Reserve Bank of Kansas City, instead stated that i rates will remain high at least until 2024.

On the macroeconomic front, the trend of new jobs in the US private sector was much better than expected in December 2022, according to the Automated Data Processing (ADP) report. Furthermore, the new ones have decreased beyond expectations claims for unemployment benefits In the USA. Again on the macro front, the trade deficit American, while the crude stocks in the last week.

They are collapsing Walgreens Boots Alliancewhich beat analysts’ expectations for the quarter but posted a net loss of $3.72 billion for a massive opioid dispute resolution burden, Silvergate Capitalwhich reported a sharp decline in deposits related to cryptocurrencies in the fourth quarter and said it would reduce its workforce by 40%, e Bed Bath & Beyondwhich stated that “there are substantial doubts about the company’s ability to continue as a going concern” and that it is exploring strategic alternatives.

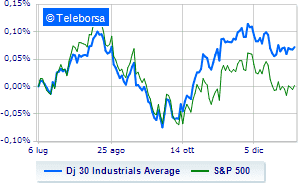

Trading down for the New York Stock Exchange, which shows a drop of 1.14% on the Dow Jones; along the same lines, bad day for theS&P-500, which continues the session at 3,809 points, down 1.15%. In red the NASDAQ 100 (-1.44%); on the same line, going down theS&P 100 (-1.1%).

To the top between Wall Street giants, Chevrons (+1.84%), Verizon Communication (+1.03%), Merck (+0.70%) and Amgen (+0.53%).

The strongest declines, however, occur on Walgreens Boots Alliancewhich continues the session with -8.07%.

Slide Salesforcewith a clear disadvantage of 3.47%.

In red Microsoftwhich shows a marked decrease of 2.87%.

The negative performance of United Healthwhich drops by 2.64%.

Between best performers of the Nasdaq 100, Pinduoduo, Inc. Sponsored Adr (+5.61%), Warner Bros. Discovery, (+3.47%), T-Mobile Us, (+2.69%) and Diamondback Energy, (+2.66%).

The worst performances, however, are recorded on Crowdstrike Holdings,which gets -8.71%.

Thump of Walgreens Boots Alliance,which shows a drop of 8.07%.

Letter about work daywhich records a significant drop of 7.31%.

Goes down Datadogwith a drop of 7.15%.