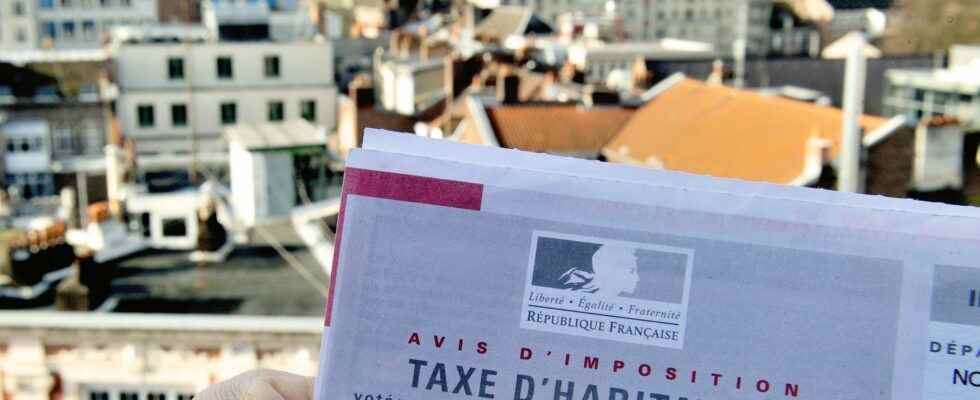

Coastal towns, tourist hotspots… We will still have to wait, to overtax second homes. Highly requested in territories with high real estate pressure, this option, defended by the government, and adopted within the framework of the finance law for 2023, has been postponed. The device was to increase to 5,000 the number of municipalities authorized to increase the housing tax on second homes, to prevent certain goods from being used only in the context of short-term rental, and to encourage the main residence.

But now, the government is backtracking. Deputy Xavier Roseren (Renaissance) announced last week that this measure would only be effective in 2024, instead of 2023.

Some municipalities could lose

Why this delay, when some municipalities in tense areas would like to speed up? “Discussions with local elected officials have led to the identification of strong concerns in several parts of the territory”, detailed Gabriel Attal, the Minister of Action and Public Accounts, on February 7 at the National Assembly. The measure is not abandoned, a decree should pass in 2023, and therefore be effective in 2024.

“First on the zoning proposed by the government, which several elected officials consider that it does not adequately treat certain parts of the territory. We must continue the exchanges”, explained Gabriel Attal.

About 1,000 municipalities have surcharged, some at 60%

And to add: “Some of the municipalities will lose the housing tax on vacant premises, it’s one or the other in the area, and we want to avoid that there are losing municipalities at the end “. Finally, the Minister expressed that this delay could prove useful, for owners and buyers to adapt. A delay that annoys some of the elected officials of the coast, very affected by the multiplication of second homes.

Thus the mayor of Sables-D’Olonne (Vendée, president of the National Association of Elected Officials of the Littoral, insists, with West France : “increasing housing tax on second homes is the only local tax lever left to municipalities to finance a proactive policy in favor of permanent residents”. In 2022, 1,136 municipalities have chosen to activate this tax lever, making it possible to increase the housing tax on second homes by up to 60%, Bercy told Capital. Such a ceiling had been reached in Nice in the Alpes-Maritimes or in Ferney-Voltaire in Ain.