(Tiper Stock Exchange) – Weak session for the main European stock exchanges, with Piazza Affari positioning itself below parityon a day devoid of great ideas in the Old Continent and that follows the marked increases of recent days, on the back of cooling US inflation which fueled expectations for a pause in aggressive monetary policy by the Fed after the July meeting. Furthermore, the Eurolists did not benefit from the positive opening of Wall Street, after the positive quarterly results of the main US banks and the insurance company UnitedHealth Group.

about theperformance of the Italian economyBankitalia – within the Economic Bulletin – stated that it foresees a GDP growth to 1.3 percent this yearto 0.9 in 2024 and 1.0 in 2025. “In the coming quarters, the recovery will be affected by the tightening of financing conditions and the weakness of international trade”, reads the document.

L’Euro / US Dollar the session continued at the previous levels, reporting a variation of +0.12%. No significant change for thegold, which trades on the previous day’s values at 1,957.7 dollars an ounce. Day to forget for the petrolium (Light Sweet Crude Oil), which trades at 75.53 dollars per barrel, down 1.77%.

Consolidate the levels of the eve lo spreadscoming in at +168 basis points, with yield of the 10-year BTP which stands at 4.16%.

In the European stock market scenario modest descent for Frankfurtwhich lost a small -0.22%, flat Londonwhich holds parity, and without cues Pariswhich does not show significant changes in prices.

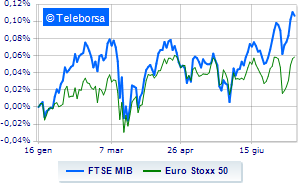

Caution prevails a Business Squarewith the FTSEMIB which closed the session with a slight drop of 0.39%, breaking the positive chain of five consecutive increases, which began last Friday; on the same line, it ranks below parity the FTSE Italia All-Share, which recedes to 30,714 points. Without direction the FTSE Italia Mid Cap (-0.19%); on the same trend, almost unchanged the FTSE Italy Star (+0.07%).

Between best Italian stocks large-cap, cash on MPS Bank, which recorded an increase of 1.72%. Positive performance for Phinecus, which shows an increase of 1.49%. Resistant Ferrariwhich marks an increase of 1.42%. amplifier advances by 0.70%.

The worst performances, however, are recorded on BPM desk, which gets -2.15%. Prey of sellers Saipem, with a decrease of 1.71%. Thoughtful Is in the, with a fractional decline of 1.45%. He hesitates ENIwith a modest drop of 1.42%.

Among the protagonists of the FTSE MidCap, Cementir (+4.04%), Caltagirone SpA (+3.68%), believe (+3.18%) and Cembre (+2.71%).

The worst performances, however, are recorded on De Nora Industries, which gets -4.06%. They focus their sales on Brunello Cucinelli, which suffers a drop of 3.60%. Sales on Datalogic, which records a drop of 1.91%. Bad sitting for Illimity Bankwhich shows a loss of 1.82%.