(Finance) – Le European stock exchanges they closed the week with another session downwhich investors concerned about prospects that central banks may confirm a restrictive stance also in the coming months and from the news arriving from China. After the recent disappointing macroeconomic data and the problems related to the payment of interest on the debt by the Country Garden company, the Evergrande real estate group filed for bankruptcy today and filed for protection from creditors in a New York court.

Beyond the news arriving from the East, the analysts of Intesa Sanpaolo write, “the sales stage which characterizes the trend of the markets in the last few sessions justification in the solid year-to-date gainsin a context of risk aversion”.

L’Euro / US Dollar the session continued at the previous levels, reporting a variation of +0.03%. L’Gold the session continued at the previous levels, reporting a variation of +0.11%. Positive session for petrolium (Light Sweet Crude Oil), which shows a gain of 0.36%.

Consolidate the levels of the eve lo spreadscoming in at +172 basis points, with yield of the 10-year BTP which stands at 4.31%.

Among the European lists small loss for Frankfurtwhich trades at -0.65%, hesitates Londonwhich lost 0.65%, and substantially weak Pariswhich recorded a decrease of 0.38%.

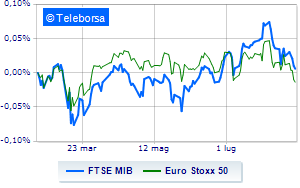

TO Milancloses below parity on FTSEMIB, which drops to 27,762 points, with a percentage gap of 0.42%, continuing on the bearish trail represented by three consecutive drops, in place since last Wednesday; along the same lines, depressed the FTSE Italia All-Share, which trades below the previous day’s levels at 29,751 points. Just below parity the FTSE Italia Mid Cap (-0.51%); as well as, negative changes to the FTSE Italy Star (-0.82%).

Among the best Blue Chips of Piazza Affari, a small step forward for Hera, which shows a progress of 1.24%. Composed Is in the, which grows by a modest +0.68%. Modest performance for DiaSorinwhich shows a moderate increase of 0.65%.

The strongest declines, however, occur on MPS Bank, which continues the session with -3.99%. They focus their sales on Saipem, which suffers a drop of 2.41%. Sales on amplifier, which records a drop of 1.78%. Bad sitting for Ferrariwhich shows a loss of 1.62%.

Among the protagonists of the FTSE MidCap, MortgagesOnline (+1.84%), IREN (+1.55%), Eurogroup Laminations (+1.40%) and Ascopiave (+1.18%).

The worst performances, however, are recorded on Alerion Clean Power, which gets -3.09%. Under pressure Tod’s, which shows a drop of 2.61%. Slide Cembre, with a clear disadvantage of 2.40%. In red Zignago Glasswhich shows a marked decrease of 2.04%.