(Finance) – Marked rise for Rivian Automotivewhich translates into a profit of 2.25% on previous values.

Assisting the actions is DA Davidson’s assessment that Rivian’s entry into Europe with electric delivery vans built for Amazon will happen much sooner than expected. According to analyst Michael Shlisky, the EV maker’s stock is turning more positive.

Shlisky upgraded the stock’s rating to “neutral” from “underperform” and raised his price target to $18 from $11.

E-commerce giant Amazon said it will soon use US startup Rivian’s first electric vans for deliveries in Europe. The first 300 vans will be operational in Germany in the cities of Munich, Berlin and Dusseldorf. The delivery vans used in Germany are shorter and slimmer than their US counterparts, to better adapt to European roads.

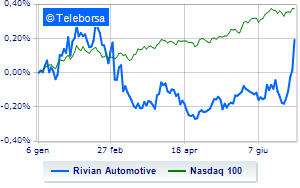

The analysis of the stock performed on a weekly basis highlights the bullish trendline of American electric car manufacturer more pronounced than the trend of NASDAQ 100. This expresses the market’s greater attractiveness towards the stock.

Signs of strengthening for the short-term trend with the most immediate resistance seen at USD 20.89, with a current stage controlling support level estimated at 19.27. The balanced bullish strength of Rivian Automotive it is supported by the upward crossing of the 5-day moving average over the 34-day moving average. Due to the technical implications assumed, we should see a continuation of the bullish phase towards 22.5.