Created by the Pacte law to simplify and harmonize the various existing retirement savings systems, the retirement savings plan (PER) allows you to put money aside with the aim of supplementing your income in retirement. If savings remain blocked until the legal retirement age, the PER benefits from several strong advantages including the deductibility of payments from its taxable income and the possibility of recovering its capital in the form of an annuity or capital – a choice. Savers are not mistaken: according to the Ministry of the Economy and Finance, more than 7 million people owned one at the end of 2022, totaling more than 80 billion euros in assets. “The PER is a well-established product that exceeds all collection objectives,” comments Eric Rosenthal, deputy general manager of savings and financial services at Apicil. Here are our tips for making the most of it.

1. Juggle between individual and collective systems

There are several types of PER: individual, which can be taken out by anyone with their bank or insurer, and collective and compulsory PER, reserved for employees of companies which make them available. The first replaces the Perco (collective retirement savings plan) and the second, the “article 83” retirement contract. Envelopes of which the beneficiaries are not always aware. However, 1 in 4 employees have a PER. “He can thus access a competitive savings product since it is the company which pays the costs of the envelope, which have also been negotiated beforehand,” underlines Benjamin Pedrini, general manager of Epsor.

In this case, subscribing to an individual product is not essential, especially since it is entirely possible to make free payments (deductible from income) on these envelopes. “One is not the enemy of the other. Everything depends on its objective, but we must keep in mind that the compulsory PER only allows you to take out an annuity,” emphasizes Eric Rosenthal. Mixing your payments into two envelopes can sometimes be of interest, especially since company schemes traditionally provide access to a simpler financial offer than individual PERs. “Historically, the types of supports eligible for these collective envelopes were very limited. However, since the Pacte law, we can reference index management, private equityreal estate, etc.”, argues Benjamin Pedrini.

Another element to take into account: most collective PERs are in securities account format while individual PERs are essentially based on life insurance. This implies different legal and tax treatment in the event of death. “The insurance PER makes it possible to designate beneficiaries who will receive death benefits within the favorable framework of life insurance,” indicates Christine Valence, wealth engineer at BNP Paribas private bank. On the other hand, the sums saved on a PER subscribed in the form of a securities account are included in the event of the disappearance of the subscriber in the estate assets.” And therefore taxed. Another weak point: “They also do not benefit from a minimum death guarantee, which makes it possible to compensate for a loss in value in the event of death during a market trough”, underlines Alexandre Boutin, director of heritage engineering at Primal.

© / The Express

2. Pay the right amount

The strength of the PER lies in its tax leverage, which allows you to build retirement capital while reducing your taxes. Be careful, however: amounts tax-exempt at entry will be taxed at exit. The operation nevertheless remains interesting, especially for households anticipating a drop in income – and therefore taxes – in retirement.

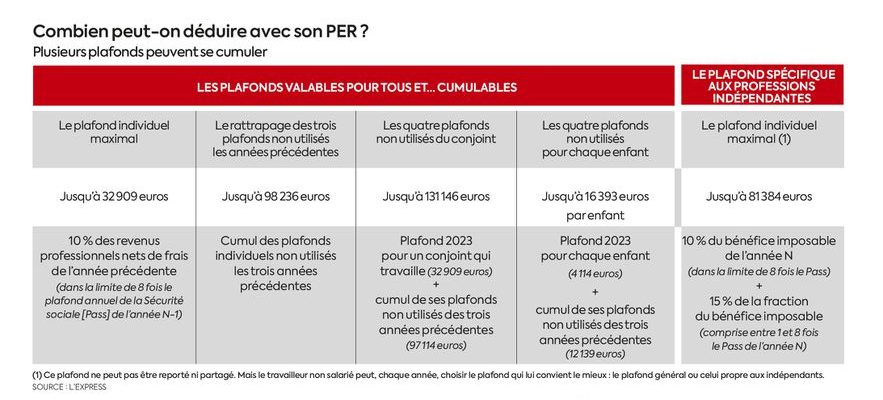

Start by checking your retirement savings limit, which determines the maximum deductible amount. You can pay up to 10% of your 2022 income, with a minimum set at 10% of the annual Social Security (Pass) ceiling, i.e. 4,114 euros for this year, and a maximum set at 10% of eight times the Pass, or 32,909 euros. It is also possible to use the remaining ceilings not used over the last three years. These amounts appear on your tax notice, but they do not take into account any payments already made during the year.

To go even further, you can pool your ceiling with that of your spouse or PACS partner, if the latter does not consume it in full. Last option to increase the tax impact of the PER: open and fund a plan for each of your children attached to the tax household. The latter benefit from an individual ceiling of 4,114 euros in the absence of income.

Beforehand, check the tax impact. The higher your marginal tax bracket, the more significant it will be. Thus, for a taxpayer located in the 41% bracket, a payment of 10,000 euros will result in a tax saving of 4,100 euros. For the 30% tranche, the rebate will this time be 3,000 euros, etc. “Below 30%, the tax leverage becomes very weak,” recommends Alexandre Boutin.

Depending on your income, you will not have the same ability to save money. “Remember to look as a priority if you benefit from a contribution from your company, indicates Benjamin Pedrini. This takes the form of a bonus, conditional on a payment effort. But this can be smoothed over the remaining four months of the year.” Another option, reserved for employees leaving their company: pay in unused leave days.

3. Gather your assets as much as possible

To avoid multiplying the envelopes and forgetting them, the Pacte law introduced the transferability to the PER of capital registered on the various retirement savings contracts taken out during one’s working life. “The logic is as follows: no matter the professional path, which can be scalable, there is a unique solution,” explains Alexandre Boutin. This concerns new plans but also old products (Perco, article 83, Perp and Madelin).

“A certain number of elements must be taken into account before transferring an old contract to a PER”, however, warns Christine Valence. Several scenarios can encourage you to keep your Perp and Madelin. First of all, even if they plan to take out a life annuity, the insurer prefers to pay a capital if they have little funds. This is the case when the annuity is less than 110 euros per month, which represents a capital of around 35,000 to 45,000 euros, according to the Financial Union of France (UFF). “In this case, you benefit from the capital outflow, and this under more favorable tax conditions than those of the PER since the tax is only 7.5%”, relates Valérie Bentz, head of heritage studies at the ‘UFF. Capital outflow is also authorized in the case of Perp in the event of acquisition of the main residence – provided you have not been an owner for two years. Finally, “it is appropriate to examine the guarantees provided for in the Madelin contract and in particular the existence of a mortality table which can allow the saver to benefit from conditions of conversion into an annuity defined in advance and sometimes advantageous”, underlines Christine Valence. An asset to take into account even if you are not a fan of annuity…

4. Think about transmission

If the PER allows you to build up additional income for retirement, it is possible to pass it on if you do not consume all the saved capital. In the event of death before age 70, the life insurance system applies with a reduction of 152,500 euros per beneficiary. Beyond this, the sums are subject to inheritance tax after a reduction of 30,500 euros, all beneficiaries and all contracts combined. But we must not forget that the spouse or PACS partner is exempt. In this case, “the PER becomes a real tool for protecting the spouse since in the event of death, the latter receives the capital if he is the beneficiary of the contract, without having to pay tax or social security contributions”, points out Valérie Bentz. The tax advantage received upon entry remains acquired.