With the change in the real estate situation, evidenced by a notable decrease in the number of transactions and price drops of 2 to 15% over the last twelve months, opportunities are starting to emerge. But if you are considering investing in rental property, don’t let yourself be seduced by just a high rate of return. Here are some tips to avoid making a mistake.

1. Make your operation as secure as possible

As the real estate market is in a downturn, you have to invest for the long term. To do this, only select apartments that will appeal to the greatest number of people. So, unless you come across a particularly low price or buy a student studio, avoid those located beyond the third floor without an elevator – especially if it is impossible to install one. Because your target tenants will be smaller, excluding seniors and families with young children. Likewise, if you opt for student shared accommodation, check that it will be possible to rent this large apartment to a family later if your first idea does not prove profitable.

Before purchasing, carry out simulations and calculate your return on investment using pessimistic assumptions. In particular, include a regular increase in rental charges and property taxes. If you are a newbie, get help from a professional. “We adapt to the client’s situation and, above all, draw their attention to points that are sometimes forgotten, for example the drop in their income at the time of retirement, and therefore in their tax rate,” points out Pierre Brunet, founder of the Alter-Invest firm.

© / The Express

2. Find out about the city’s rental market

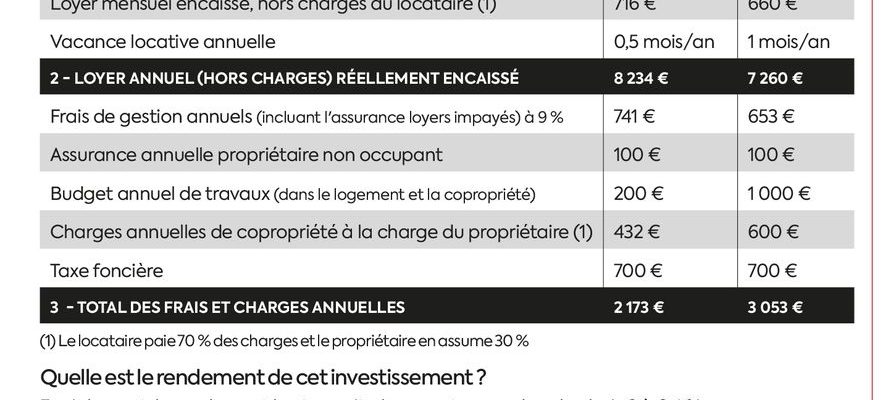

Technically, “the rate of return on housing is calculated by dividing the amount of the annual rent by the purchase price”, explains Franck Vignaud, director of the Real Estate Laboratory. In fact, this calculation must be refined because, depending on the city and the type of property, the differences are significant. You should therefore not focus only on gross profitability, but check the amounts that will actually come back to you, by calculating the “net-net” profitability, once charges and taxes have been deducted..

First, take into account the tension in the rental market. Because if in certain metropolises, housing in good condition finds a buyer in less than two weeks, it is not the same in medium-sized towns, where it can remain empty for a month or more between two occupants.

The type of property and the rental method also play a role. For example, a two-room apartment is more expensive in a furnished shared accommodation for two students than empty for a young worker. But if the first leave for a gap semester, you will have difficulty finding an occupant in February and your overall profitability will drop… “To remain prudent, it is necessary to integrate a month of vacancy every twenty-four months in tense areas to small housing or not counting on a rent increase during the simulation”, advises Guillaume Berthiaux, head of private management at Sofidy.

3. Set your rent strictly

The level of rent is obviously a key point in the success of your real estate transaction. However, never rely on the ceilings defined by management in certain cities (Bordeaux, Lille, Paris, etc.) or set for different schemes (Loc’Avantages, Pinel, etc.) because they are sometimes higher than the rents actually charged. Specialized sites (Clameur, Meilleursagents, etc.) indicate average amounts by property type, but they must be refined by a field survey. “In Marseille, depending on the location, prices can vary from one to two,” specifies Jean-Luc Lieutaud, director of Unis Paca. Also take into account the co-ownership charges because, between a small building where they are low, and a large co-ownership where they are high, the net rent can vary from… 40 to 60%.

Don’t forget the management fees, generally between 8 and 10% of the monthly payments – including unpaid rent insurance. The latter can be replaced by the Visale guarantee, a free guarantee for lessors. “In the event of default by the occupant, it ensures the payment of monthly payments as well as the repair costs, within the limits of certain ceilings”, specifies Sylvie Eschalier, responsible for the mobilization of housing within the framework of the “Owners” system. and solidarity” at Habitat et Humanisme. To benefit from it, you must sign a mobility lease (one to ten months) with a tenant under 30 years old. If he is older, he must be a private sector employee and earn less than 1,500 euros net per month or be in a professional transfer (CDD for less than six months, CDI in trial period, with promise of employment or mutating).

4. Integrate taxation

Lessors pay local taxes, the amount of which varies greatly from one city to another. According to the 2022 observatory of the National Union of Real Estate Property (UNPI), the accumulation of property tax rates, household waste removal and ancillary taxes can in fact go from simple to… quintuple. “The differences are sometimes significant within the same metropolis,” notes Frédéric Zumbiehl, in charge of the property tax observatory at the UNPI. In the North, this overall rate is 62.28% in Lille, but 48.11% in Marcq-en-Barœul, a neighboring municipality. Conversely, Paris displays an overall rate of 20.29%, while it is 53.19% in Pantin, in the inner suburbs. To know if it is really worth investing, compare these taxes to the monthly rent. If the former represent more than one and a half times the latter, the operation clearly loses its interest.

This is especially true as you will also be taxed on your rental income. If the accommodation is rented empty and if you receive less than 15,000 euros of property income per year, the microland regime applies by default. After a 30% reduction, rents are taxed with your other income (salaries, retirement pensions, etc.) and subject to social security contributions of 17.2%. “If it is rented furnished and if the rental income does not exceed 77,700 euros per year, the reduction increases to 50% with the micro-BIC regime (industrial and commercial profits)”, recalls Christophe Chaillet, director of the heritage engineering at HSBC Continental Europe. Beyond these ceilings, or at your option, you are taxed at the real rate. Unfurnished as well as furnished, you can then deduct all of your charges (loan interest, insurance, work, etc.) from your rental income and – only when furnished – depreciate, in addition, the property and the furniture.

Be careful, however, not to choose your investment based on tax criteria alone, because the advantage enjoyed by furnished rentals is increasingly denounced. It could therefore be revised downwards in the near future.

5. Account for additional expenses

Contrary to popular belief, a real estate investment never pays for itself. So always keep some cash in case of a setback to restore the property between two tenants, pay for unforeseen collective works or to turn your back in the event of a long vacancy. To avoid unpleasant surprises, check the condition of the building and the work in progress, voted on or planned in the short term. “You have to ask for the minutes of the last general meetings of the co-ownership, but also the convocations, which sometimes contain more information than the agendas,” suggests Guillaume Berthiaux.

Are you reassured about the condition of the condominium but your apartment needs to be renovated? Have the cost of the work calculated by a professional. To finance part of it, take advantage of public aid and subsidies (MaPrimeRénov’, Anah aid, zero-interest eco-loan, etc.). If you renovate it energetically by insulating it from the inside, also calculate your “loss of value”. In fact, lining the walls reduces the surface area and value of the property, which depend on its size.

As daunting as they may be, all these operations are essential to avoid disappointments. Because if over the last ten years, poor profitability could be compensated by a nice capital gain on resale, this is no longer so obvious when buying today. “The drop in prices that we are experiencing is likely to last several years,” assures Julien Karakok, director of the Rive Ouest agencies in Hauts-de-Seine. To make a winning investment, you will have to focus more than ever on the real profitability of your property.