(Finance) – After a start on parity, the European markets move lower on the day of FED President’s speech at the Jackson Hole Annual Symposium. A week with markets waiting and attention focused on the words of American central bankers, should not be interpreted as a sign that most of the volatility is behind us, according to analysts. “Volatility is unlikely to subside anytime soon and this should lead to opportunities – commented Mark Dowding, CIO of BlueBay – In this context, we prefer to take a patient view and wait for clearer and more asymmetrical opportunities to arise. The macro divergence that we are looking at between Europe and North America right now is unusual on a historical basis and the the remainder of 2022 looks set to remain as problematic as the rest of the year“.

Meanwhile, investors find themselves assessing the trend in consumer confidence in the main European economies. According to Istat, the confidence of Italian companies it was down for the second consecutive month in August, while the consumer sentiment it returned to June levels, which were still low.

The trust of the German consumers, according to data from the GfK institute, it fell to a new all-time low for the third consecutive month, with the propensity to save rising to its highest value in more than eleven years. In France consumer confidence improved slightly in August.

Liquidity continues to represent the preferred form of savings allocation by Italians, even if the need for greater diversification towards mutual funds and insurance policies is growing, according to what emerges from an analysis by the FABI banking syndicate on savings of Italians over the last ten years.

Slight increase forEuro / US dollar, which shows a rise of 0.31%. Sitting in fractional reduction for thegold, which for now leaves 0.66% on the parterre. The Petroleum (Light Sweet Crude Oil) continues trading, with an increase of 1.29%, to $ 93.71 per barrel.

Salt it spreadsettling at +229 basis points, an increase of 6 basis points, with the yield of Ten-year BTP equal to 3.63%.

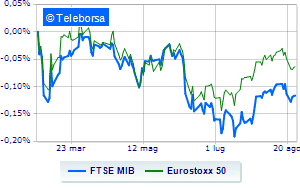

Among the markets of the Old Continent moves below par Frankfurtshowing a decrease of 0.37%, a cautious trend for Londonwhich shows a performance of + 0.02%, and moderate contraction for Pariswhich suffers a decline of 0.38%.

Day “no” for the Italian stock exchangedown by 0.72% on FTSE MIB, breaking the positive chain of three consecutive rises, which began last Tuesday; along the same lines, it yields to sales the FTSE Italia All-Share, which falls back to 24,362 points. Below parity the FTSE Italia Mid Cap, which shows a decrease of 0.50%; as well as, negative changes for the FTSE Italia Star (-0.93%).

Top of the ranking of the most important titles of Milan, we find Telecom Italia (+ 1.01%) e Unipol (+ 0.53%).

The strongest sales, on the other hand, show up on Ivecowhich continues trading at -2.63%.

Negative sitting for Amplifonwhich drops by 2.27%.

Sensitive losses for Recordatidown 2.07%.

Suffers CNH Industrialwhich shows a loss of 2.07%.

Between best stocks in the FTSE MidCap, Alerion Clean Power (+ 3.88%), Datalogic (+ 2.75%), Saras (+ 2.51%) e El.En (+ 0.79%).

The worst performances, on the other hand, are recorded on GVSwhich gets -3.65%.

Breathless SOLwhich fell by 2.83%.

Prey of the sellers Wiitwith a decrease of 1.69%.

Sales focus on Brunello Cucinelliwhich suffers a decline of 1.60%.